Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A., Economic Indicators

Por um escritor misterioso

Last updated 26 março 2025

Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data was reported at 0.000 % pa in Jul 2019. This stayed constant from the previous number of 0.000 % pa for Jul 2019. Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data is updated daily, averaging 0.000 % pa from Jan 2012 to 03 Jul 2019, with 1865 observations. The data reached an all-time high of 14.290 % pa in 27 Apr 2013 and a record low of 0.000 % pa in 03 Jul 2019. Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data remains active status in CEIC and is reported by Central Bank of Brazil. The data is categorized under Brazil Premium Database’s Interest and Foreign Exchange Rates – Table BR.MB045: Lending Rate: per Annum: by Banks: Pre-Fixed: Corporate Entities: Vendor. Lending Rate: Daily: Interest rates disclosed represent the total cost of the transaction to the client, also including taxes and operating. These rates correspond to the average fees in the period indicated in the tables. There are presented only institutions that had granted during the period determined. In general, institutions practicing different rates within the same type of credit. Thus, the rate charged to a customer may differ from the average. Several factors such as the time and volume of the transaction, as well as the guarantees offered, explain the differences between interest rates. Certain institutions grant allowance of the use of the term overdraft. However, this is not considered in the calculation of rates of this type. It should be noted that the overdraft is a modality that has high interest rates. Thus, its use should be restricted to short periods. If the customer needs resources for a longer period, should find ways to offer lower rates. The Brazilian Central Bank publishes these data with a delay about 20 days with relation to the reference period, thus allowing sufficient time for all Financial Institutions to deliver the relevant information. Interest rates presented in this set of tables correspond to averages weighted by the values of transactions conducted in the five working days specified in each table. These rates represent the average effective cost of loans to customers, consisting of the interest rates actually charged by financial institutions in their lending operations, increased tax burdens and operational incidents on the operations. The interest rates shown are the average of the rates charged in the various operations performed by financial institutions, in each modality. In one discipline, interest rates may differ between customers of the same financial institution. Interest rates vary according to several factors, such as the value and quality of collateral provided in the operation, the proportion of down payment operation, the history and the registration status of each client, the term of the transaction, among others . Institutions with “zero” did not operate on modalities for those periods or did not provide information to the Central Bank of Brazil. The Central Bank of Brazil assumes no responsibility for delay, error or other deficiency of information provided for purposes of calculating average rates presented in this

Banco Central do Brasil

Beyond Contributory Pensions by World Bank Publications - Issuu

The Great Recession and Developing Countries: Economic Impact and

PDF) The Political Economy of Contemporary Cuba

SEC Filing - Fusion Fuel

Peru: Third Review Under the Stand-By Arrangement and Request for

Itau Unibanco Holding S.A. Form 6-K Current Report Filed 2023-11-22

Brazil, Interest Rates

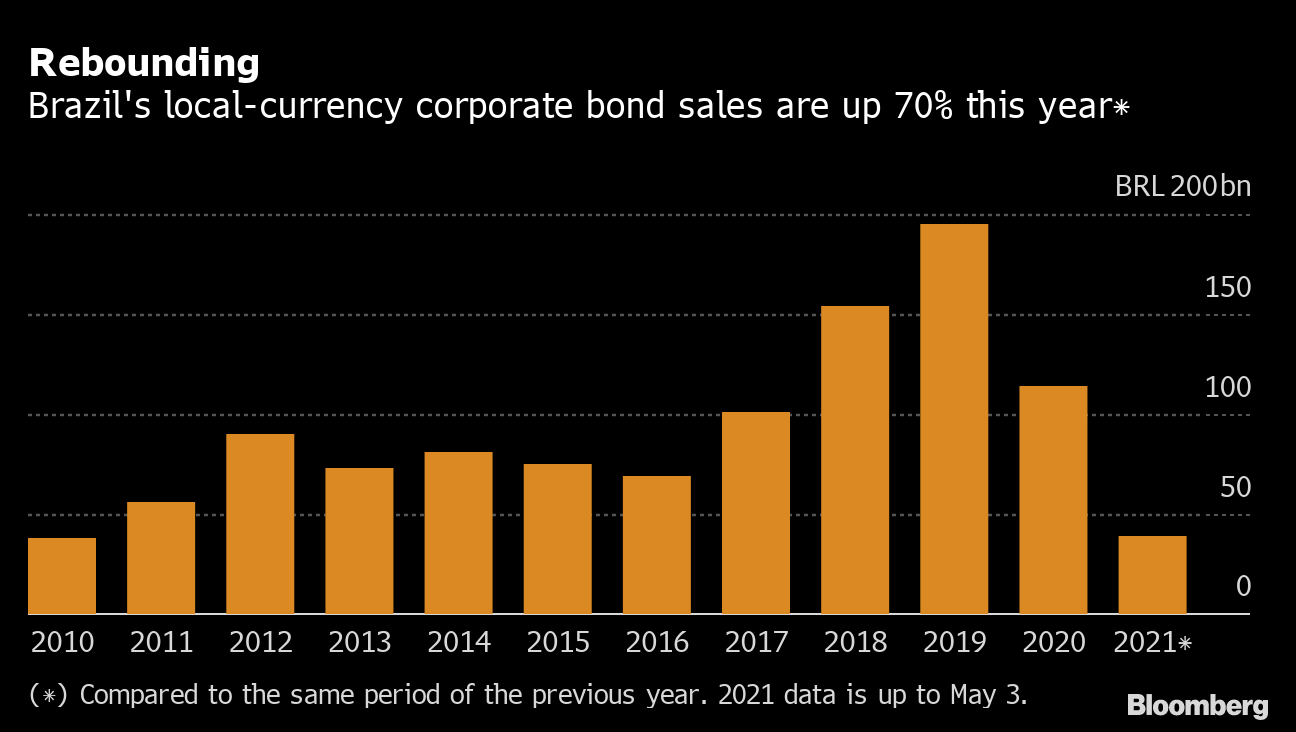

As Interest Rates Surge, Brazil Corporate Bond Market Reawakens

Recomendado para você

-

Impressoras Datacard26 março 2025

Impressoras Datacard26 março 2025 -

Jacob Barata Filho recebeu informação da Caruana sobre quebra de sigilo e quase fugiu, apontam documentos do MPF26 março 2025

Jacob Barata Filho recebeu informação da Caruana sobre quebra de sigilo e quase fugiu, apontam documentos do MPF26 março 2025 -

Caruana S.A. Sociedade de Credito, Financiamento e Investimento26 março 2025

-

Inline XBRL Viewer26 março 2025

Inline XBRL Viewer26 março 2025 -

Flashback pluggable database no Data Guard26 março 2025

Flashback pluggable database no Data Guard26 março 2025 -

408 fotos de stock e banco de imagens de Fabiano Caruana - Getty Images26 março 2025

408 fotos de stock e banco de imagens de Fabiano Caruana - Getty Images26 março 2025 -

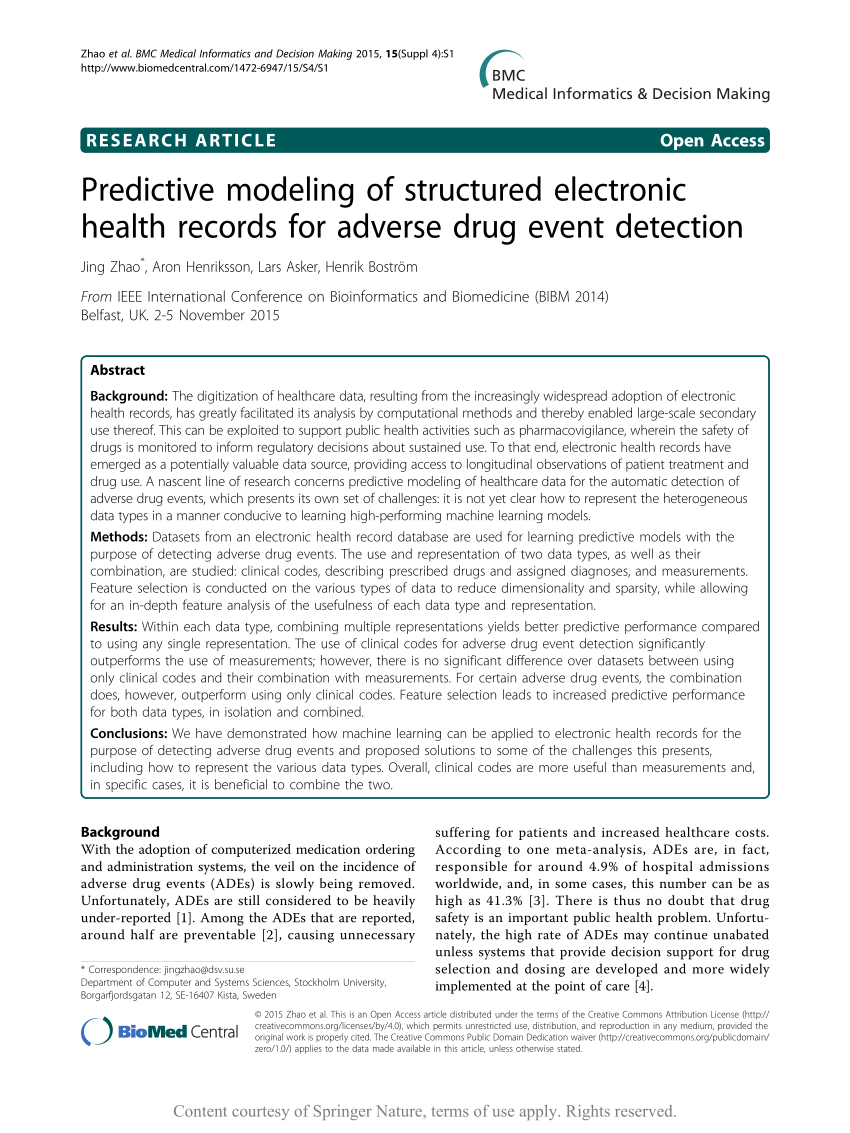

PDF) Predictive modeling of structured electronic health records for adverse drug event detection26 março 2025

PDF) Predictive modeling of structured electronic health records for adverse drug event detection26 março 2025 -

Roberto Lagalla's research works Università degli Studi di Palermo, Palermo (UNIPA) and other places26 março 2025

Roberto Lagalla's research works Università degli Studi di Palermo, Palermo (UNIPA) and other places26 março 2025 -

CEU Mass Mediator 3.0: A Metabolite Annotation Tool26 março 2025

-

Macroprudential policy and instruments: Setting counter-cyclical capital buffers in converging economies Jan Frait Executive Director Financial Stability. - ppt download26 março 2025

Macroprudential policy and instruments: Setting counter-cyclical capital buffers in converging economies Jan Frait Executive Director Financial Stability. - ppt download26 março 2025

você pode gostar

-

Tony Todd - Age, Family, Bio26 março 2025

Tony Todd - Age, Family, Bio26 março 2025 -

_POP_GLAM-1.png?sw=800&sh=800) Buy Pop! Tanjiro Kamado (Training) at Funko.26 março 2025

Buy Pop! Tanjiro Kamado (Training) at Funko.26 março 2025 -

Let the Games Begin: A Reevaluation of Michael Haneke's Funny Games « I Like Things That Look Like Mistakes26 março 2025

Let the Games Begin: A Reevaluation of Michael Haneke's Funny Games « I Like Things That Look Like Mistakes26 março 2025 -

Hurley Dives into NFTs with Super Surfer Game - NFT Plazas26 março 2025

Hurley Dives into NFTs with Super Surfer Game - NFT Plazas26 março 2025 -

盾の勇者の成り上がり RERISE - Apps on Google Play26 março 2025

-

League of Legends: LOL Patch Notes for Version 13.16 Are Here - KeenGamer26 março 2025

League of Legends: LOL Patch Notes for Version 13.16 Are Here - KeenGamer26 março 2025 -

Sonic Superstars moderniza o clássico com belo visual e zonas inéditas26 março 2025

Sonic Superstars moderniza o clássico com belo visual e zonas inéditas26 março 2025 -

Rainbow Friends Plush Blue Gift Toys for Fans and Friends26 março 2025

Rainbow Friends Plush Blue Gift Toys for Fans and Friends26 março 2025 -

4play Produções e Eventos26 março 2025

4play Produções e Eventos26 março 2025 -

One Piece GPC M.U.G.E.N, One Piece GPC M.U.G.E.N, By Bioobi26 março 2025