Historical Social Security and FICA Tax Rates for a Family of Four

Por um escritor misterioso

Last updated 20 março 2025

Average and marginal employee Social Security and Medicare (FICA) tax rates for two-parent families of four at the same relative positions in the income distribution from 1955 to 2015.

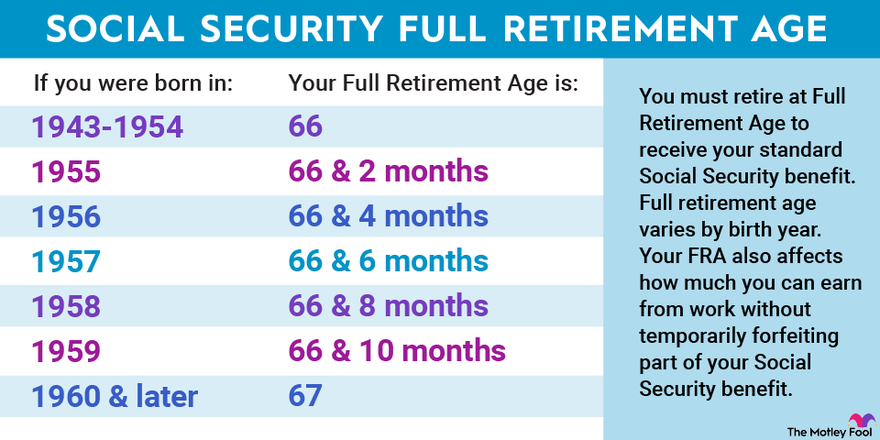

What Is My Full Retirement Age for Maximum Social Security?

Historical Federal Tax Rates by Income Group — My Money Blog

Historical Federal Income Tax Rates for a Family of Four

Research: Income Taxes on Social Security Benefits

Inflation Pushes Social Security COLA to 8.7% in 2023, Highest Increase in Four Decades - WSJ

What are the Social Security trust funds, and how are they financed?

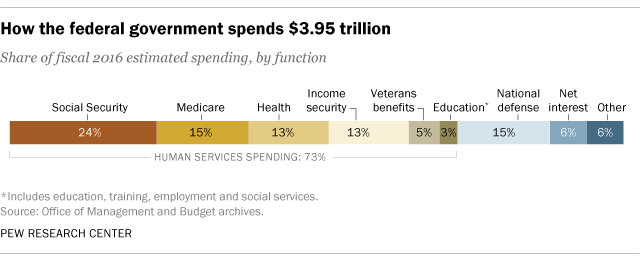

Putting federal spending in context

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

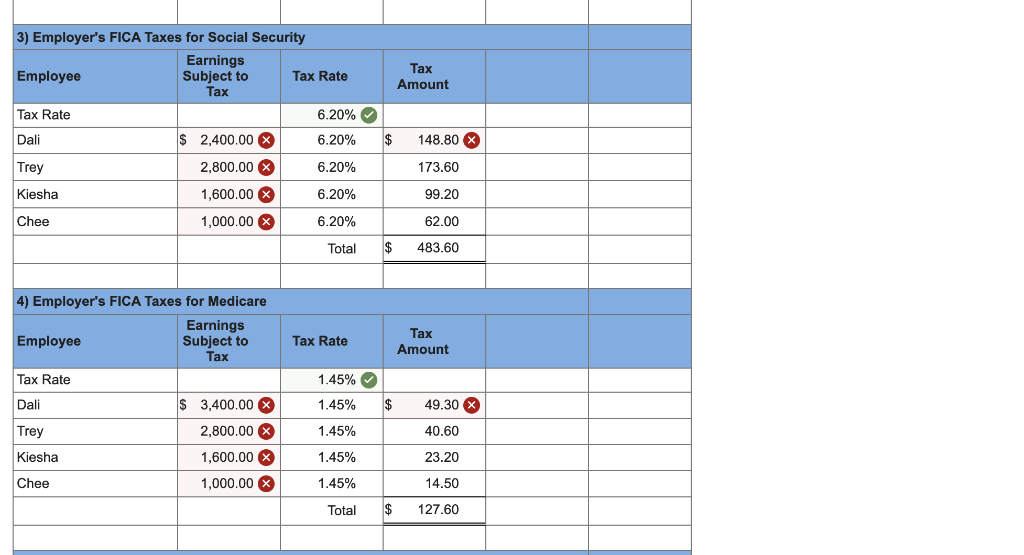

Solved Paloma Co. has four employees. FICA Social Security

Recomendado para você

-

What is Fica Tax?, What is Fica on My Paycheck20 março 2025

What is Fica Tax?, What is Fica on My Paycheck20 março 2025 -

What is FICA tax?20 março 2025

What is FICA tax?20 março 2025 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202320 março 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202320 março 2025 -

What is the FICA Tax and How Does it Connect to Social Security?20 março 2025

-

Employee Social Security Tax Deferral Repayment20 março 2025

Employee Social Security Tax Deferral Repayment20 março 2025 -

What is the FICA Tax Refund?20 março 2025

What is the FICA Tax Refund?20 março 2025 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations20 março 2025

What is a payroll tax?, Payroll tax definition, types, and employer obligations20 março 2025 -

FICA Tax in 2022-2023: What Small Businesses Need to Know20 março 2025

FICA Tax in 2022-2023: What Small Businesses Need to Know20 março 2025 -

What Are FICA Taxes And Why Do They Matter? - Quikaid20 março 2025

What Are FICA Taxes And Why Do They Matter? - Quikaid20 março 2025 -

FICA Tax Tip Fairness Pro Beauty Association20 março 2025

FICA Tax Tip Fairness Pro Beauty Association20 março 2025

você pode gostar

-

Gears 3 Story DLC to Use Spin-Off Characters - The Escapist20 março 2025

Gears 3 Story DLC to Use Spin-Off Characters - The Escapist20 março 2025 -

GP da Inglaterra de Fórmula 1: data, horários, mudança e20 março 2025

GP da Inglaterra de Fórmula 1: data, horários, mudança e20 março 2025 -

O ator está à altura? Saiba a medida dos astros do cinema - Bem20 março 2025

O ator está à altura? Saiba a medida dos astros do cinema - Bem20 março 2025 -

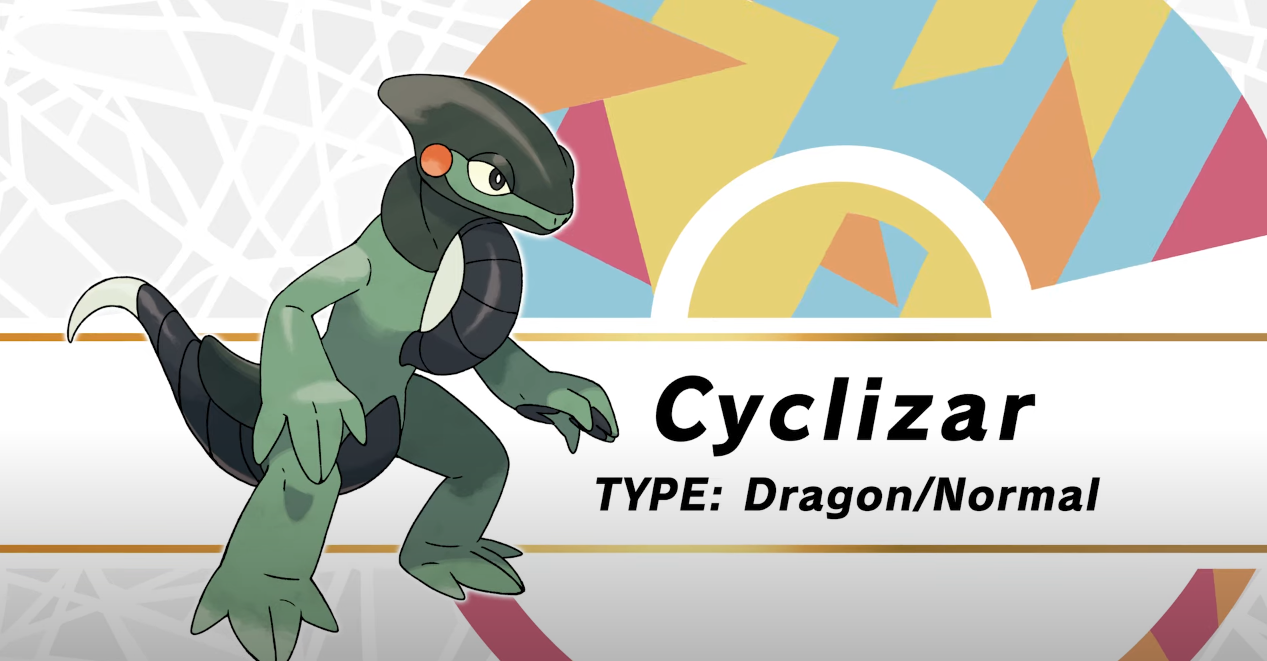

Cyclizar, Loaded Dice, and More Revealed from Pokemon Scarlet & Pokemon Violet!20 março 2025

Cyclizar, Loaded Dice, and More Revealed from Pokemon Scarlet & Pokemon Violet!20 março 2025 -

11 people taken to hospital after school bus crashes into home in Burnaby, B.C., first responders say20 março 2025

-

Nintendo Life on X: Pokémon Evolutions Episode 2 - 'The Eclipse', starring Lillie, is now live. Watch it here 👇 #Pokemon # Anime #Video / X20 março 2025

Nintendo Life on X: Pokémon Evolutions Episode 2 - 'The Eclipse', starring Lillie, is now live. Watch it here 👇 #Pokemon # Anime #Video / X20 março 2025 -

Mashle: Magic and Muscles - Hajime Komoto20 março 2025

Mashle: Magic and Muscles - Hajime Komoto20 março 2025 -

Esquadrão Imortal – Independiente 1971-1975 - Imortais do Futebol20 março 2025

Esquadrão Imortal – Independiente 1971-1975 - Imortais do Futebol20 março 2025 -

ONDE ASSISTIR DUBLADO! Dragon Ball Super Super Hero HD Filme 202220 março 2025

ONDE ASSISTIR DUBLADO! Dragon Ball Super Super Hero HD Filme 202220 março 2025 -

Plants vs. Zombies: Garden Warfare (PS4) - The Cover Project20 março 2025

Plants vs. Zombies: Garden Warfare (PS4) - The Cover Project20 março 2025