FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

Por um escritor misterioso

Last updated 10 março 2025

A guide to understanding the FICA tax, also called payroll tax - the mandatory deduction from your employee’s payroll. Know your FICA tax rates, exemptions, & tips

Understanding the FICA Tax Short for the Federal Insurance Contributions Act, FICA refers to the American law that requires both employees and employers to contribute to the cost of the Social Security and Medicare programs in the US. Therefore, the FICA tax refers to the taxes paid in accordance with this law. Let’s dive deeper with this essential guide to the FICA tax. What is the FICA Tax? The FICA tax is a mandatory deduction from an employee’s payroll. American employers must withhold a

Understanding the FICA Tax Short for the Federal Insurance Contributions Act, FICA refers to the American law that requires both employees and employers to contribute to the cost of the Social Security and Medicare programs in the US. Therefore, the FICA tax refers to the taxes paid in accordance with this law. Let’s dive deeper with this essential guide to the FICA tax. What is the FICA Tax? The FICA tax is a mandatory deduction from an employee’s payroll. American employers must withhold a

Do You Have To Pay Tax On Your Social Security Benefits?

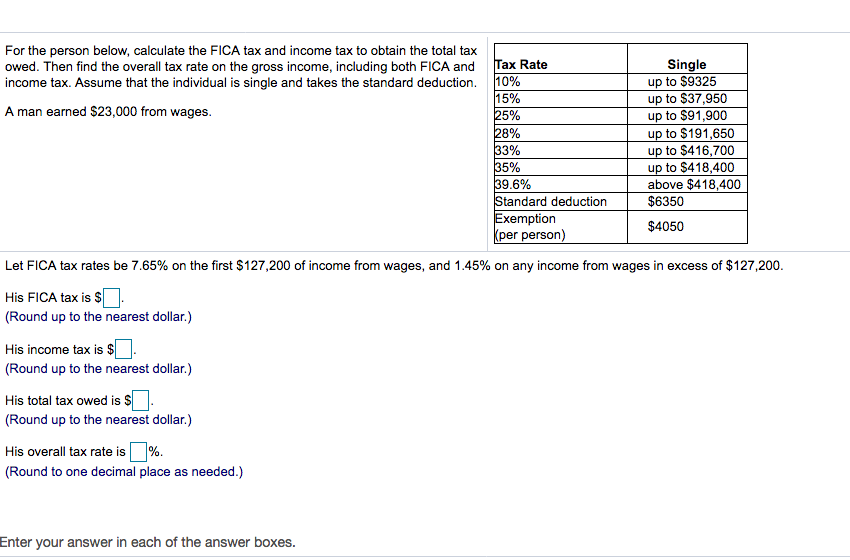

Solved For the person below, calculate the FICA tax and

What Is Medicare Tax? Definitions, Rates and Calculations - ValuePenguin

Federal & Regular FICA Tax Table Maintenance (FEDM & FEDS)

Understanding Payroll Taxes and Who Pays Them - SmartAsset

How To Calculate Payroll Taxes? FUTA, SUI and more

FICA Tax: Everything You Need to Know

How to calculate payroll taxes 2021

What is FED MED/EE Tax?

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes and Employer Responsibilities

Recomendado para você

-

What is Fica Tax?, What is Fica on My Paycheck10 março 2025

What is Fica Tax?, What is Fica on My Paycheck10 março 2025 -

What Is FICA Tax: How It Works And Why You Pay10 março 2025

What Is FICA Tax: How It Works And Why You Pay10 março 2025 -

Overview of FICA Tax- Medicare & Social Security10 março 2025

Overview of FICA Tax- Medicare & Social Security10 março 2025 -

The FICA Tax: How Social Security Is Funded – Social Security Intelligence10 março 2025

The FICA Tax: How Social Security Is Funded – Social Security Intelligence10 março 2025 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social10 março 2025

-

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and10 março 2025

-

2017 FICA Tax: What You Need to Know10 março 2025

2017 FICA Tax: What You Need to Know10 março 2025 -

2019 US Tax Season in Numbers for Sprintax Customers10 março 2025

2019 US Tax Season in Numbers for Sprintax Customers10 março 2025 -

FICA Tax Tip Fairness Pro Beauty Association10 março 2025

FICA Tax Tip Fairness Pro Beauty Association10 março 2025 -

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons10 março 2025

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons10 março 2025

você pode gostar

-

Sanrio Puroland - Puroland is celebrating its Christmas event, PURO WHITE CHRISTMAS, running from November 8th to December 25th♪ This year we are starring Little Twin Stars, Kiki and Lala! The theme10 março 2025

-

Tie Break Padel (@tie.breakpadel) • Instagram photos and videos10 março 2025

-

Orga (Aldnoah.Zero)10 março 2025

Orga (Aldnoah.Zero)10 março 2025 -

El Peñas on X: ¿Por qué debes usar los Pokémon de tipo siniestro? / X10 março 2025

El Peñas on X: ¿Por qué debes usar los Pokémon de tipo siniestro? / X10 março 2025 -

Fury, Worry, and Walkouts: Inside Activision Blizzard's Week of10 março 2025

Fury, Worry, and Walkouts: Inside Activision Blizzard's Week of10 março 2025 -

VI Torneio de Xadrez de Vidigueira teve elevada participação10 março 2025

VI Torneio de Xadrez de Vidigueira teve elevada participação10 março 2025 -

Armored Core VI Release date predictions??? : r/armoredcore10 março 2025

Armored Core VI Release date predictions??? : r/armoredcore10 março 2025 -

Mini Squishable Wizard10 março 2025

Mini Squishable Wizard10 março 2025 -

Chega às concessionárias a nova Yamaha YZF-R110 março 2025

-

Indian Captivities Or, Life In The Wigwam; Being True Narratives Of Captives Who Have Been Carried Away By The Indians; From The Frontier Settlements Of The U.S.; From The Earliest Period To10 março 2025

Indian Captivities Or, Life In The Wigwam; Being True Narratives Of Captives Who Have Been Carried Away By The Indians; From The Frontier Settlements Of The U.S.; From The Earliest Period To10 março 2025