Withholding FICA Tax on Nonresident employees and Foreign Workers

Por um escritor misterioso

Last updated 04 fevereiro 2025

The proper determination of FICA tax exemption for nonresident employees has become particularly tricky for payroll staff in organizations across the US. In this guide, we share some tips for effective management of nonresident payroll.

Income Taxes and FICA Withholding Exemption(s) for Foreign Workers

Useful Tips for Non-Resident Aliens Earning a Living in the US

Payroll for remote employees: 2023 tax guide

What Is FICA?

Resident vs nonresident frequently asked questions

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

Withholding Tax Explained: Types and How It's Calculated

FICA Tax Exemption for Nonresident Aliens Explained

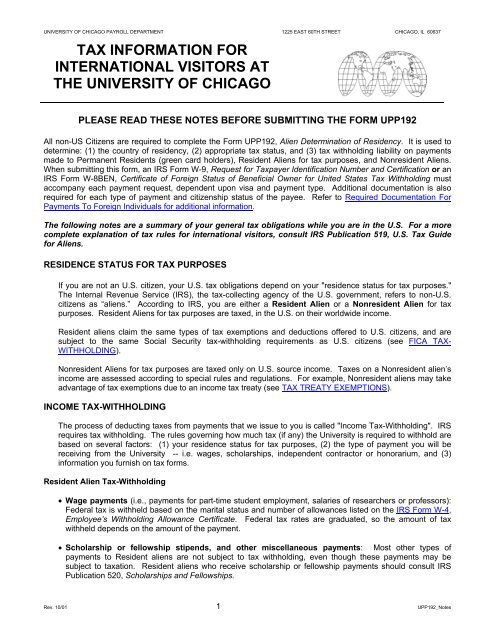

UPP 192 Instructions - University of Chicago

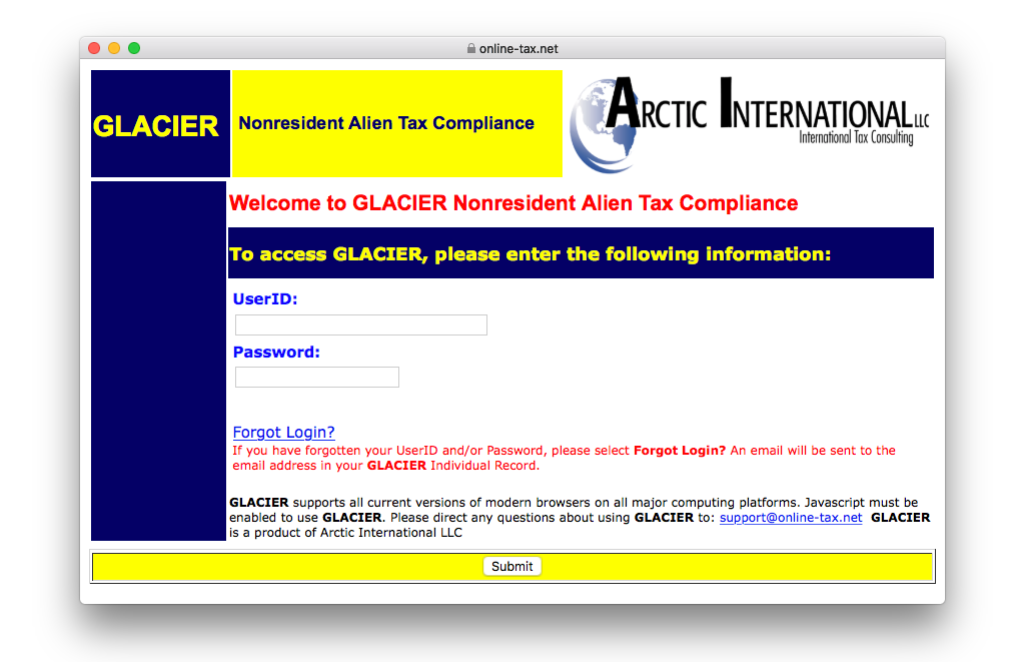

Glacier Nonresident Alien Tax Compliance System - Payroll

FICA: Definition, 2022 Rates and Limits, Rules for Self-Employed

How To Calculate Payroll Taxes? FUTA, SUI and more

Recomendado para você

-

Important 2020 Federal Tax Deadlines for Small Businesses - Workest04 fevereiro 2025

Important 2020 Federal Tax Deadlines for Small Businesses - Workest04 fevereiro 2025 -

2023 FICA Tax Limits and Rates (How it Affects You)04 fevereiro 2025

2023 FICA Tax Limits and Rates (How it Affects You)04 fevereiro 2025 -

FICA Tax: Understanding Social Security and Medicare Taxes04 fevereiro 2025

-

Employee Social Security Tax Deferral Repayment04 fevereiro 2025

Employee Social Security Tax Deferral Repayment04 fevereiro 2025 -

What are FICA Tax Payable? – SuperfastCPA CPA Review04 fevereiro 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review04 fevereiro 2025 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations04 fevereiro 2025

What is a payroll tax?, Payroll tax definition, types, and employer obligations04 fevereiro 2025 -

FICA Tax in 2022-2023: What Small Businesses Need to Know04 fevereiro 2025

FICA Tax in 2022-2023: What Small Businesses Need to Know04 fevereiro 2025 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social04 fevereiro 2025

-

How An S Corporation Reduces FICA Self-Employment Taxes04 fevereiro 2025

How An S Corporation Reduces FICA Self-Employment Taxes04 fevereiro 2025 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax04 fevereiro 2025

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax04 fevereiro 2025

você pode gostar

-

It's time to celebrate the FUTTIES with Twitch Prime and FIFA 19!04 fevereiro 2025

It's time to celebrate the FUTTIES with Twitch Prime and FIFA 19!04 fevereiro 2025 -

𝚁𝚞𝚜𝚜𝚎𝚕𝚕 on X: 𝚃𝚑𝚎 𝚐𝚞𝚊𝚛𝚍𝚒𝚊𝚗𝚜 (𝚙𝚝.𝟷) #doorsroblox # doors #doorsfanart / X04 fevereiro 2025

𝚁𝚞𝚜𝚜𝚎𝚕𝚕 on X: 𝚃𝚑𝚎 𝚐𝚞𝚊𝚛𝚍𝚒𝚊𝚗𝚜 (𝚙𝚝.𝟷) #doorsroblox # doors #doorsfanart / X04 fevereiro 2025 -

![Fir on X: [Naver Post] Behind ENHYPEN 'Sacrifice (Eat Me Up)' MV #HEESEUNG #희승 / X](https://pbs.twimg.com/media/Fyqms5uaAAENcVK.jpg) Fir on X: [Naver Post] Behind ENHYPEN 'Sacrifice (Eat Me Up)' MV #HEESEUNG #희승 / X04 fevereiro 2025

Fir on X: [Naver Post] Behind ENHYPEN 'Sacrifice (Eat Me Up)' MV #HEESEUNG #희승 / X04 fevereiro 2025 -

Vampire: The Masquerade - Bloodlines 2 - Xbox One04 fevereiro 2025

Vampire: The Masquerade - Bloodlines 2 - Xbox One04 fevereiro 2025 -

Powerwolf - Metallum Nostrum, Releases04 fevereiro 2025

Powerwolf - Metallum Nostrum, Releases04 fevereiro 2025 -

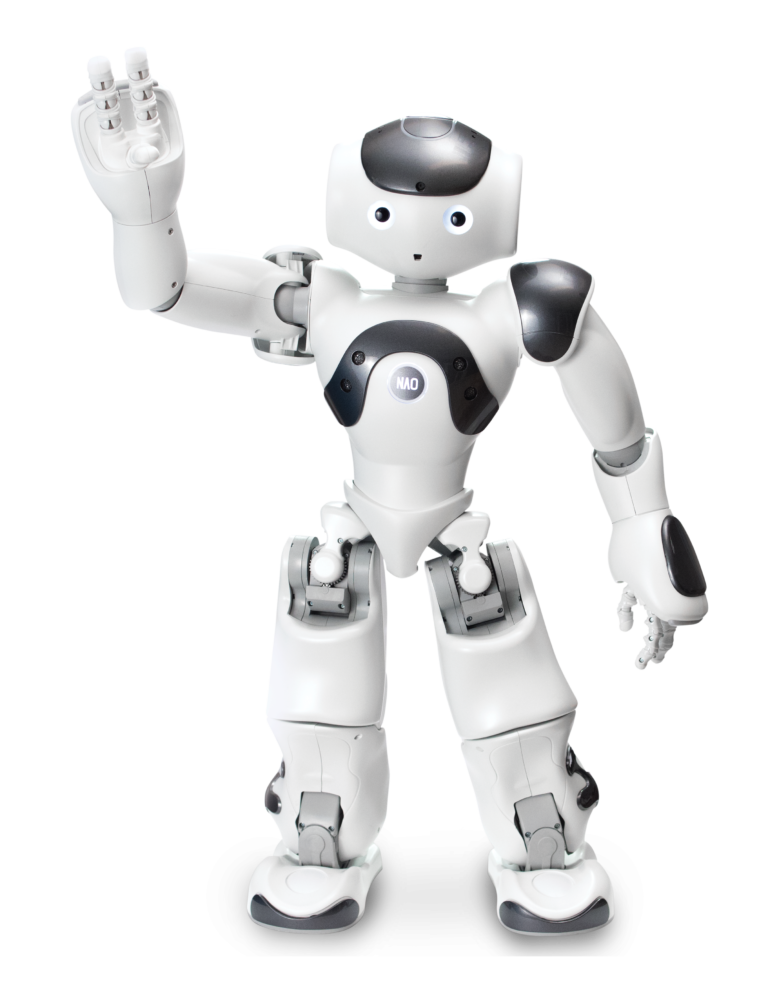

NAO - Pluginbot04 fevereiro 2025

NAO - Pluginbot04 fevereiro 2025 -

SUSSY BAKA! 1 1 Project by Ethereal Beryllium04 fevereiro 2025

SUSSY BAKA! 1 1 Project by Ethereal Beryllium04 fevereiro 2025 -

Roblox Promo Codes Gifts & Merchandise for Sale04 fevereiro 2025

Roblox Promo Codes Gifts & Merchandise for Sale04 fevereiro 2025 -

Blu-ray - Inferno de Dante - Edição com Luva Erupção (Exclusivo)04 fevereiro 2025

Blu-ray - Inferno de Dante - Edição com Luva Erupção (Exclusivo)04 fevereiro 2025 -

Assistir Shikkakumon no Saikyou Kenja Dublado - Episódio - 1204 fevereiro 2025

Assistir Shikkakumon no Saikyou Kenja Dublado - Episódio - 1204 fevereiro 2025