Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Last updated 09 março 2025

:max_bytes(150000):strip_icc()/independent-contractor.asp-FINAL-6904c017dfbf4da18e90cf4db4af91e7.png)

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

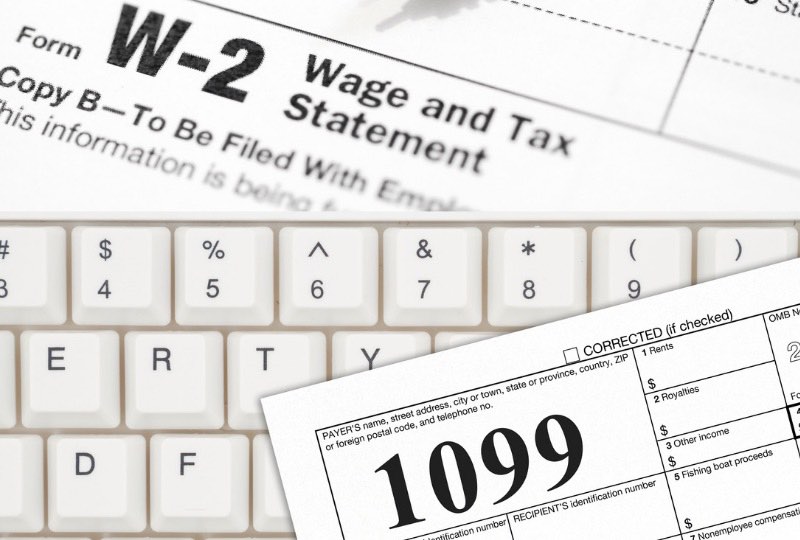

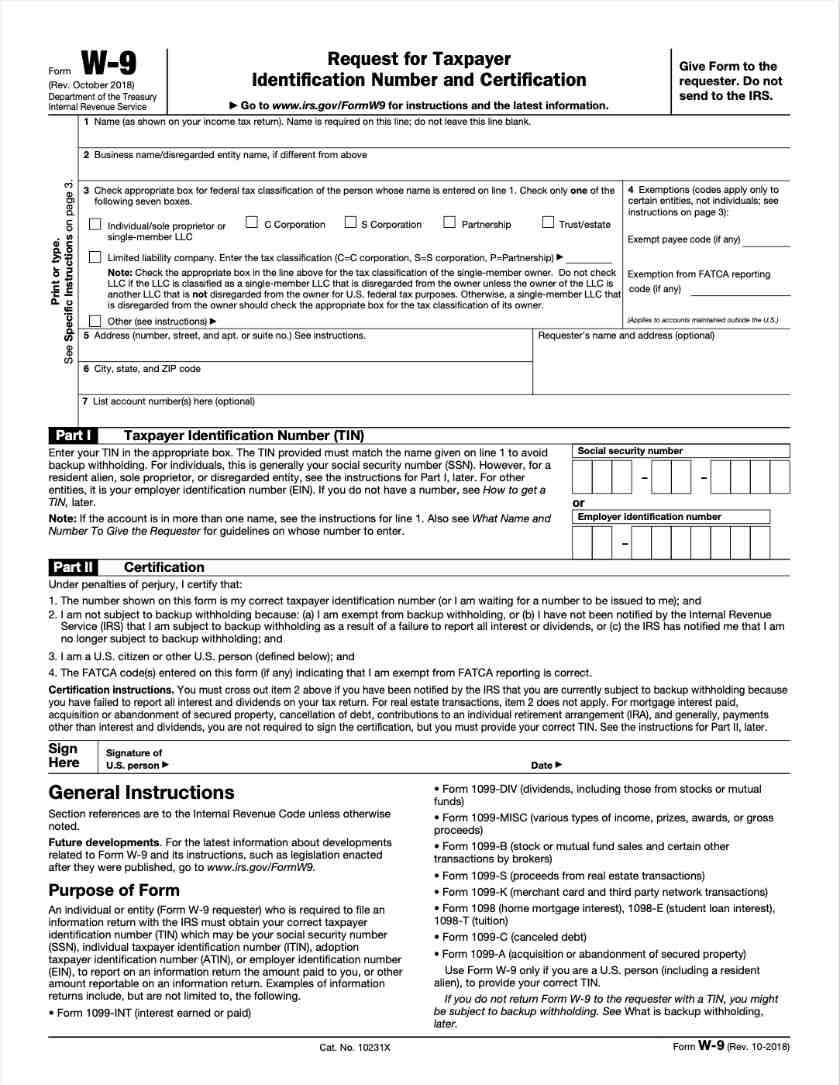

What's the Difference Between W-2, 1099, and Corp-to-Corp Workers?

Understanding Taxes - Tax Tutorial: Payroll Taxes and Federal

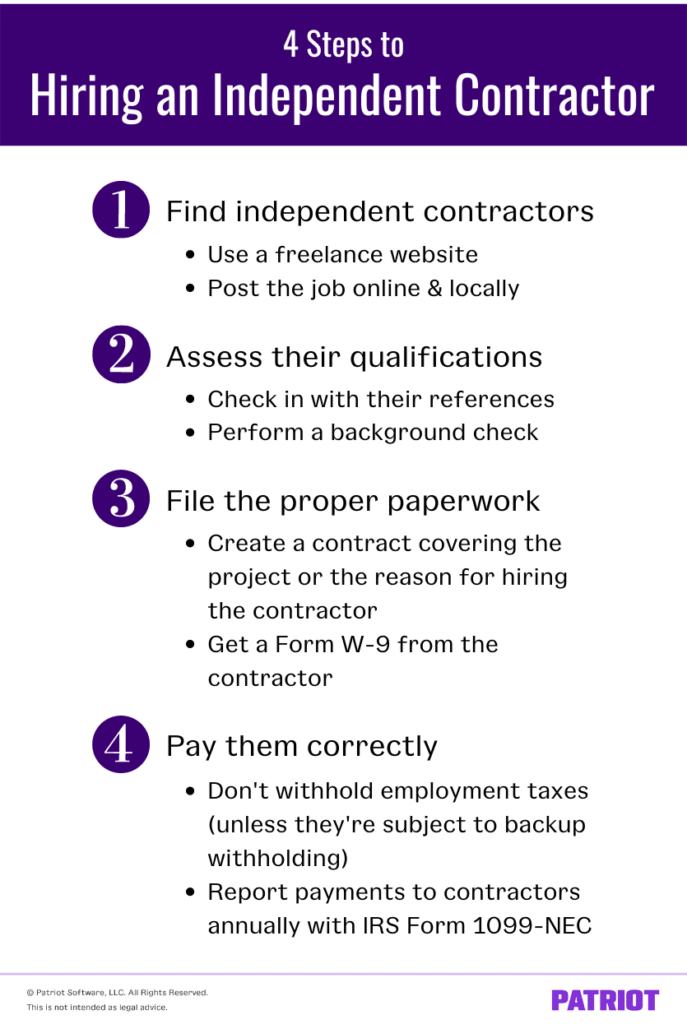

Paying Independent Contractors: How to Set Up and Issue Payments

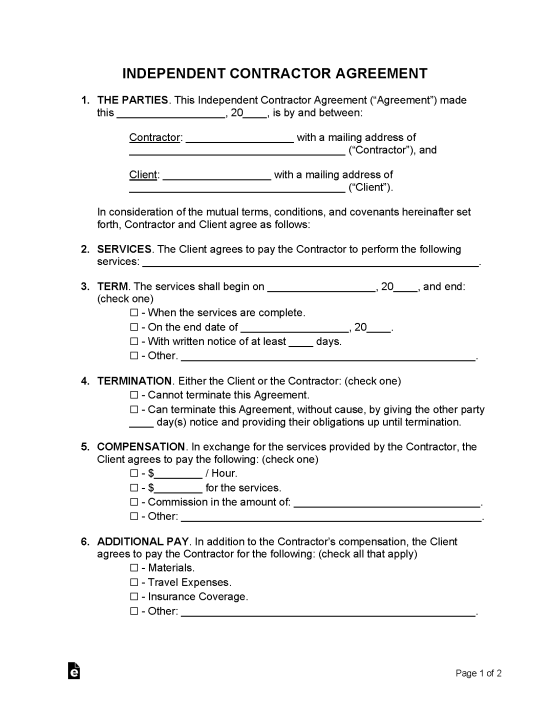

Free Independent Contractor Agreements (46) - PDF

Definition of an Independent Contractor, How Taxes Work, and an

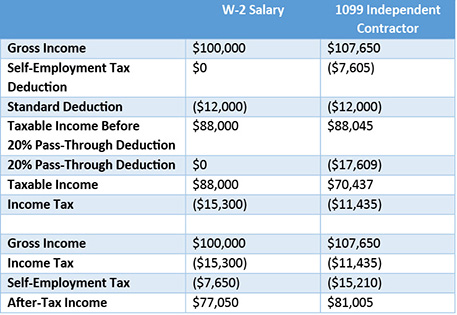

Employee vs. Independent Contractor: How Tax Reform Impacts

What's the Difference Between W-2 Employees and 1099 Contractors

How Much Should I Save for 1099 Taxes? [Free Self-Employment

A Guide to Independent Contractor Taxes - Ramsey

Independent Contractor Expenses Spreadsheet [Free Template]

Everything to Know About Hiring an Independent Contractor

Recomendado para você

-

Rule 63, Teh Meme Wiki09 março 2025

Rule 63, Teh Meme Wiki09 março 2025 -

Urban Dictionary on X: @Ac1d_Ra1n_ Rule 34: Generally accepted internet rule that states that pornog / X09 março 2025

Urban Dictionary on X: @Ac1d_Ra1n_ Rule 34: Generally accepted internet rule that states that pornog / X09 março 2025 -

Cambodian cuisine - Wikipedia09 março 2025

Cambodian cuisine - Wikipedia09 março 2025 -

Bibliography — Dumbarton Oaks09 março 2025

Bibliography — Dumbarton Oaks09 março 2025 -

Celebrity deaths 2022: The famous faces and notable figures we said goodbye to this year, Ents & Arts News09 março 2025

Celebrity deaths 2022: The famous faces and notable figures we said goodbye to this year, Ents & Arts News09 março 2025 -

Perdido Street Station (Bas-Lag) by Miéville, China09 março 2025

Perdido Street Station (Bas-Lag) by Miéville, China09 março 2025 -

Manna From Heaven”? : How Health and Education Pay the Price for Self-Dealing in Equatorial Guinea09 março 2025

Manna From Heaven”? : How Health and Education Pay the Price for Self-Dealing in Equatorial Guinea09 março 2025 -

Regular Figures, Minimal Transitivity, and Reticular Chemistry - Liu - 2018 - Israel Journal of Chemistry - Wiley Online Library09 março 2025

Regular Figures, Minimal Transitivity, and Reticular Chemistry - Liu - 2018 - Israel Journal of Chemistry - Wiley Online Library09 março 2025 -

Rabat - Wikipedia09 março 2025

Rabat - Wikipedia09 março 2025 -

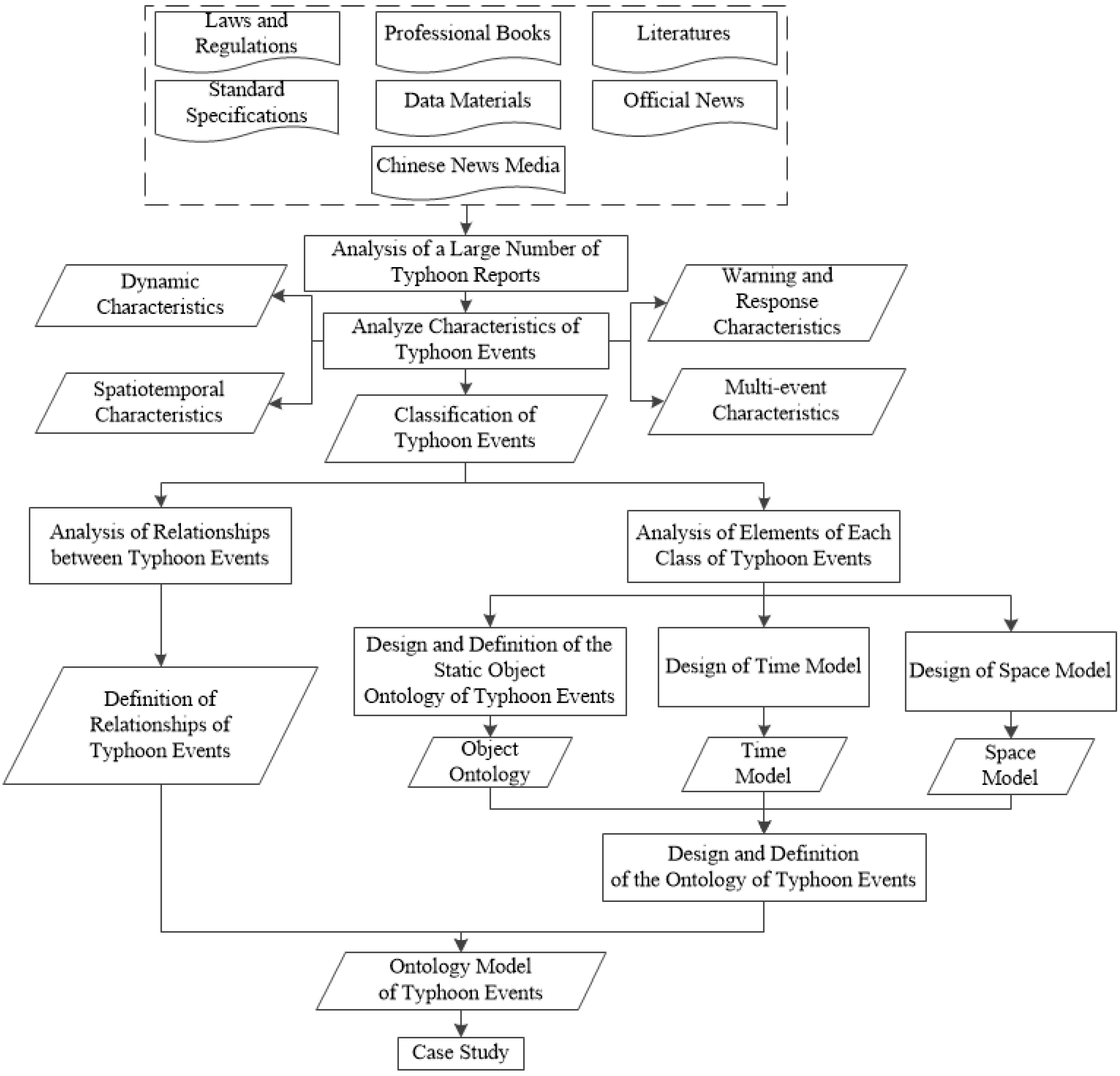

IJGI, Free Full-Text09 março 2025

IJGI, Free Full-Text09 março 2025

você pode gostar

-

2015–16 R.S.C. Anderlecht season - Wikipedia09 março 2025

2015–16 R.S.C. Anderlecht season - Wikipedia09 março 2025 -

Year 6 Big Christmas Quiz!09 março 2025

-

Quiz : Which FNAF Character Has A Huge Crush On You? - ProProfs Quiz09 março 2025

Quiz : Which FNAF Character Has A Huge Crush On You? - ProProfs Quiz09 março 2025 -

Buy Alone In The Dark: The New Nightmare Steam09 março 2025

Buy Alone In The Dark: The New Nightmare Steam09 março 2025 -

/cdn.vox-cdn.com/uploads/chorus_image/image/70371298/48672973201_ebdcad3d43_h.0.jpg) Days Gone developer pitched Resistance reboot, but Sony didn't09 março 2025

Days Gone developer pitched Resistance reboot, but Sony didn't09 março 2025 -

Dragon Ball Z® Budokai Tenkaichi 3 (2007)09 março 2025

Dragon Ball Z® Budokai Tenkaichi 3 (2007)09 março 2025 -

Nightmare, Fatal Conflict Fanon Wiki09 março 2025

Nightmare, Fatal Conflict Fanon Wiki09 março 2025 -

K-ON Comic World09 março 2025

K-ON Comic World09 março 2025 -

id de roupas masculinas para o brookhaven (versão mandrake) #brookhaven # roblox09 março 2025

id de roupas masculinas para o brookhaven (versão mandrake) #brookhaven # roblox09 março 2025 -

Skeppy holding Diamond block, Minecraft Skin09 março 2025