Brazil Lending Rate: per Annum: Pre-Fixed: Individuals: Overdraft: Banco A. J. Renner S.A., Economic Indicators

Por um escritor misterioso

Last updated 02 abril 2025

Brazil Lending Rate: per Annum: Pre-Fixed: Individuals: Overdraft: Banco A. J. Renner S.A. data was reported at 366.350 % pa in Jul 2019. This records an increase from the previous number of 365.970 % pa for Jul 2019. Brazil Lending Rate: per Annum: Pre-Fixed: Individuals: Overdraft: Banco A. J. Renner S.A. data is updated daily, averaging 0.000 % pa from Jan 2012 to 03 Jul 2019, with 1866 observations. The data reached an all-time high of 367.240 % pa in 23 Nov 2018 and a record low of 0.000 % pa in 09 Nov 2018. Brazil Lending Rate: per Annum: Pre-Fixed: Individuals: Overdraft: Banco A. J. Renner S.A. data remains active status in CEIC and is reported by Central Bank of Brazil. The data is categorized under Brazil Premium Database’s Interest and Foreign Exchange Rates – Table BR.MB030: Lending Rate: per Annum: by Banks: Pre-Fixed: Individuals: Overdraft. Lending Rate: Daily: Interest rates disclosed represent the total cost of the transaction to the client, also including taxes and operating. These rates correspond to the average fees in the period indicated in the tables. There are presented only institutions that had granted during the period determined. In general, institutions practicing different rates within the same type of credit. Thus, the rate charged to a customer may differ from the average. Several factors such as the time and volume of the transaction, as well as the guarantees offered, explain the differences between interest rates. Certain institutions grant allowance of the use of the term overdraft. However, this is not considered in the calculation of rates of this type. It should be noted that the overdraft is a modality that has high interest rates. Thus, its use should be restricted to short periods. If the customer needs resources for a longer period, should find ways to offer lower rates. The Brazilian Central Bank publishes these data with a delay about 20 days with relation to the reference period, thus allowing sufficient time for all Financial Institutions to deliver the relevant information. Interest rates presented in this set of tables correspond to averages weighted by the values of transactions conducted in the five working days specified in each table. These rates represent the average effective cost of loans to customers, consisting of the interest rates actually charged by financial institutions in their lending operations, increased tax burdens and operational incidents on the operations. The interest rates shown are the average of the rates charged in the various operations performed by financial institutions, in each modality. In one discipline, interest rates may differ between customers of the same financial institution. Interest rates vary according to several factors, such as the value and quality of collateral provided in the operation, the proportion of down payment operation, the history and the registration status of each client, the term of the transaction, among others . Institutions with “zero” did not operate on modalities for those periods or did not provide information to the Central Bank of Brazil. The Central Bank of Brazil assumes no responsibility for delay, error or other deficiency of information provided for purposes of calculating average rates presented in this

a_jhfundsii.htm

Articles and Publications

PDNN140316C by Peninsula Daily News & Sequim Gazette - Issuu

SEI Institutional International Trust

Bulletin Daily Paper 2/2/12 by Western Communications, Inc. - Issuu

PDF) The Supply of Credit Money and Capital Accumulation: A

PDF) The profile of time allocation in the metabolic pattern of

SEI Institutional International Trust

2009-2d-10 by CNBAM - Issuu

Books: Affordable Care Act / Obamacare

Recomendado para você

-

Problems reading filenames with accents on Windows · Issue #1345 · tidyverse/readr · GitHub02 abril 2025

Problems reading filenames with accents on Windows · Issue #1345 · tidyverse/readr · GitHub02 abril 2025 -

Resumen - Universidad de Navarra02 abril 2025

Resumen - Universidad de Navarra02 abril 2025 -

2014 Santander International Banking Conference02 abril 2025

2014 Santander International Banking Conference02 abril 2025 -

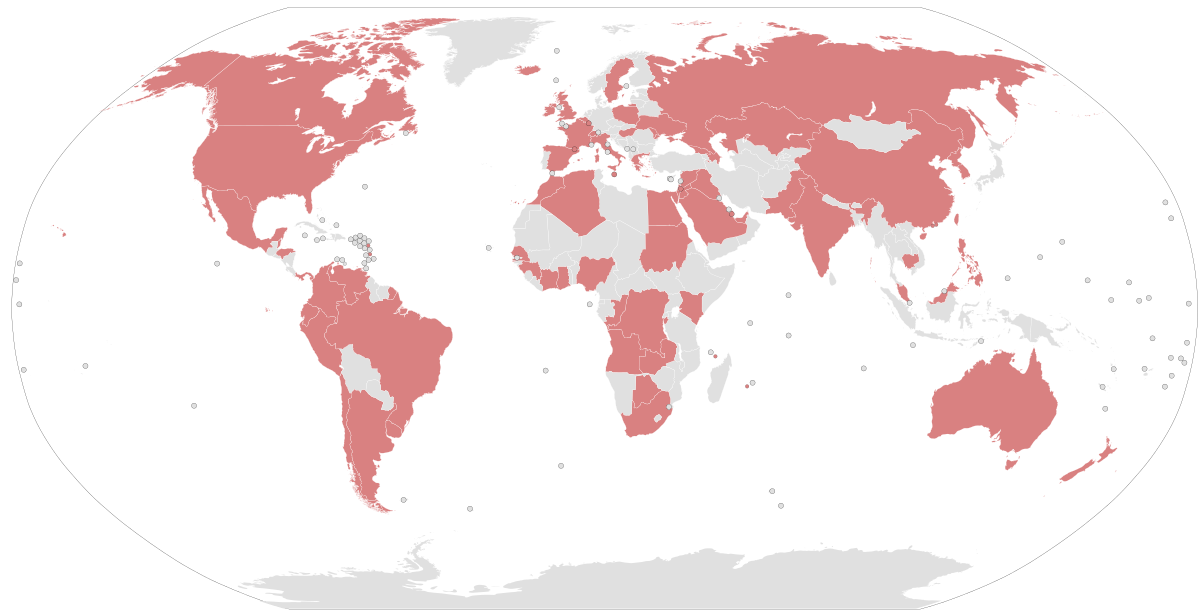

Panama Papers - Wikipedia02 abril 2025

Panama Papers - Wikipedia02 abril 2025 -

Banking reputation and CSR: a stakeholder value approach - Naples02 abril 2025

Banking reputation and CSR: a stakeholder value approach - Naples02 abril 2025 -

CEU Mass Mediator 3.0: A Metabolite Annotation Tool02 abril 2025

-

Calibration alternatives to logistic regression and their potential for transferring the statistical dispersion of discriminatory power into uncertainties in probabilities of default - Journal of Credit Risk02 abril 2025

Calibration alternatives to logistic regression and their potential for transferring the statistical dispersion of discriminatory power into uncertainties in probabilities of default - Journal of Credit Risk02 abril 2025 -

Pix – Caruana Financeira02 abril 2025

Pix – Caruana Financeira02 abril 2025 -

Recommendations for Intraoperative Adverse Events Data Collection in Clinical Studies and Study Protocols. An ICARUS Global Surgical Collaboration Study. - Abstract - Europe PMC02 abril 2025

Recommendations for Intraoperative Adverse Events Data Collection in Clinical Studies and Study Protocols. An ICARUS Global Surgical Collaboration Study. - Abstract - Europe PMC02 abril 2025 -

Daily Schedules - Federal Reserve Bank of New York02 abril 2025

Daily Schedules - Federal Reserve Bank of New York02 abril 2025

você pode gostar

-

WATCH: Drift king attempts to slide entire length of the iconic02 abril 2025

WATCH: Drift king attempts to slide entire length of the iconic02 abril 2025 -

Mini Sinuca MercadoLivre 📦02 abril 2025

Mini Sinuca MercadoLivre 📦02 abril 2025 -

Buy Dead Island Definitive Edition (PC) - Steam Key - GLOBAL - Cheap - !02 abril 2025

-

Copa 2022: bola saiu no gol do Japão? Veja como ângulo influenciou VAR02 abril 2025

Copa 2022: bola saiu no gol do Japão? Veja como ângulo influenciou VAR02 abril 2025 -

A blood-moon themed boss for my planned terraria mod. I need name02 abril 2025

A blood-moon themed boss for my planned terraria mod. I need name02 abril 2025 -

GitHub - leokashmir/fluxus-executer02 abril 2025

-

Life is Strange: True Colors - how powers work in gameplay02 abril 2025

Life is Strange: True Colors - how powers work in gameplay02 abril 2025 -

EXCLUSIVE: GTA 6 story details, release date & new GTA Online map - Xfire02 abril 2025

EXCLUSIVE: GTA 6 story details, release date & new GTA Online map - Xfire02 abril 2025 -

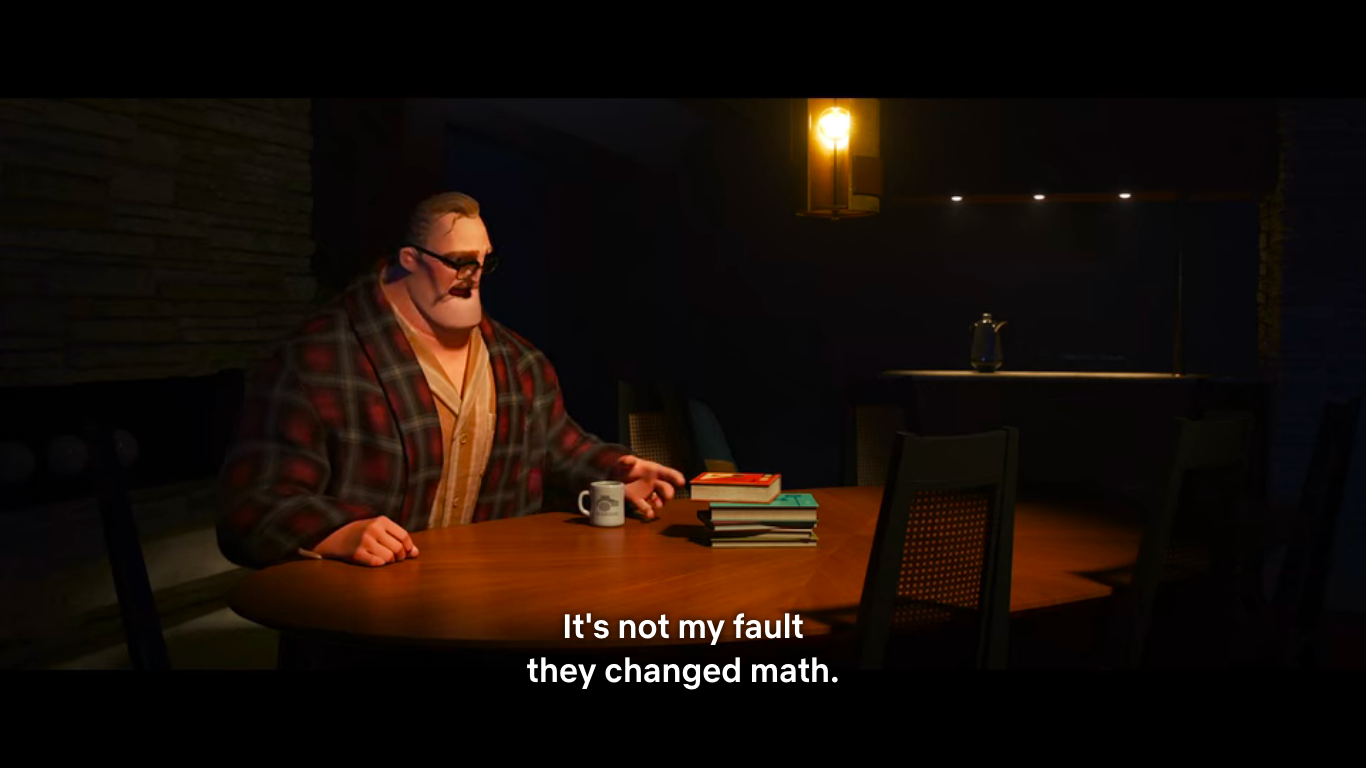

Mythbusting Mr. Incredible's New Math — The PhD Princess02 abril 2025

Mythbusting Mr. Incredible's New Math — The PhD Princess02 abril 2025 -

Here's a look at Half-Life: Alyx being played without VR02 abril 2025

Here's a look at Half-Life: Alyx being played without VR02 abril 2025