What Is FICA Tax, Understanding Payroll Tax Requirements

Por um escritor misterioso

Last updated 20 setembro 2024

FICA tax refers to the taxes withheld by employers for Social Security and Medicare. Learn more about the FICA tax and how it’s calculated.

Federal Insurance Contributions Act - Wikipedia

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

What is FICA Tax? - The TurboTax Blog

Social Security (FICA) Tax Halt May Result in Future Difficulties for Feds

Payroll Tax Withholding in 2023: State Taxes, Local Taxes, Unemployment Taxes, FICA and Medicare Tax

The FICA Tax: How Social Security Is Funded – Social Security Intelligence

Payroll Taxes: What Are They and What Do They Fund?

FICA Tax Guide (2023): Payroll Tax Rates, Definition and Meaning

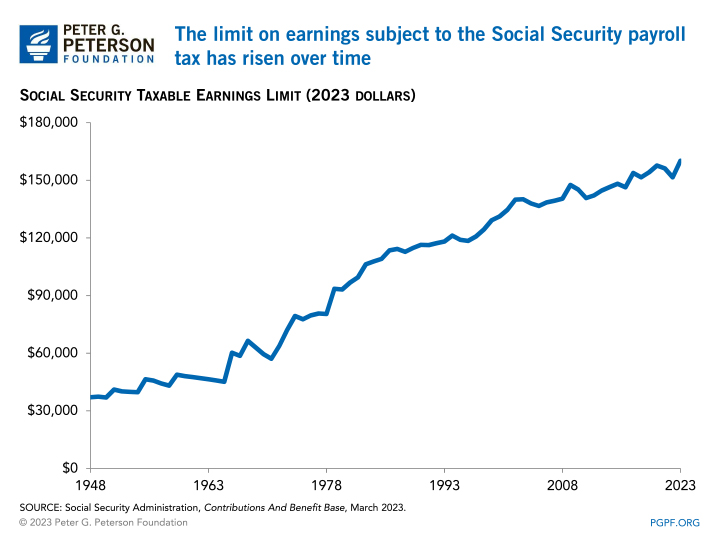

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

Recomendado para você

-

What are FICA Taxes? 2022-2023 Rates and Instructions20 setembro 2024

-

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers20 setembro 2024

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers20 setembro 2024 -

FICA Tax: Understanding Social Security and Medicare Taxes20 setembro 2024

-

How An S Corporation Reduces FICA Self-Employment Taxes20 setembro 2024

How An S Corporation Reduces FICA Self-Employment Taxes20 setembro 2024 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and20 setembro 2024

-

IRS Form 843 - Request a Refund of FICA Taxes20 setembro 2024

IRS Form 843 - Request a Refund of FICA Taxes20 setembro 2024 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine20 setembro 2024

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine20 setembro 2024 -

Understanding FICA Taxes and Wage Base Limit20 setembro 2024

Understanding FICA Taxes and Wage Base Limit20 setembro 2024 -

FICA Tax & Who Pays It20 setembro 2024

FICA Tax & Who Pays It20 setembro 2024 -

What are FICA Taxes? Social Security & Medicare Taxes Explained20 setembro 2024

você pode gostar

-

Fear the Walking Dead20 setembro 2024

-

100 Doors Games: School Escape - Apps on Google Play20 setembro 2024

-

Normal No Noobs Communityleague replay - Perdunok (2 - 020 setembro 2024

Normal No Noobs Communityleague replay - Perdunok (2 - 020 setembro 2024 -

Motocicleta de corrida futurista baseada na ducati 916 sps20 setembro 2024

Motocicleta de corrida futurista baseada na ducati 916 sps20 setembro 2024 -

Base de Rap Romãntico - Beat de Trap Romantico Uso Livre (Prod.Beats)20 setembro 2024

Base de Rap Romãntico - Beat de Trap Romantico Uso Livre (Prod.Beats)20 setembro 2024 -

FNAF Movie Explained: Mike's Quest to Save His Sister and Uncover the Truth — Eightify20 setembro 2024

FNAF Movie Explained: Mike's Quest to Save His Sister and Uncover the Truth — Eightify20 setembro 2024 -

BUYING A CRASHED TESLA IN DUBAI20 setembro 2024

BUYING A CRASHED TESLA IN DUBAI20 setembro 2024 -

O Grande Campeão - Filme 2002 - AdoroCinema20 setembro 2024

O Grande Campeão - Filme 2002 - AdoroCinema20 setembro 2024 -

Combo Ice + rengoku no Blox Fruits - Rink20 setembro 2024

Combo Ice + rengoku no Blox Fruits - Rink20 setembro 2024 -

Agar.io / The Coding Train20 setembro 2024

Agar.io / The Coding Train20 setembro 2024