Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Last updated 12 março 2025

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

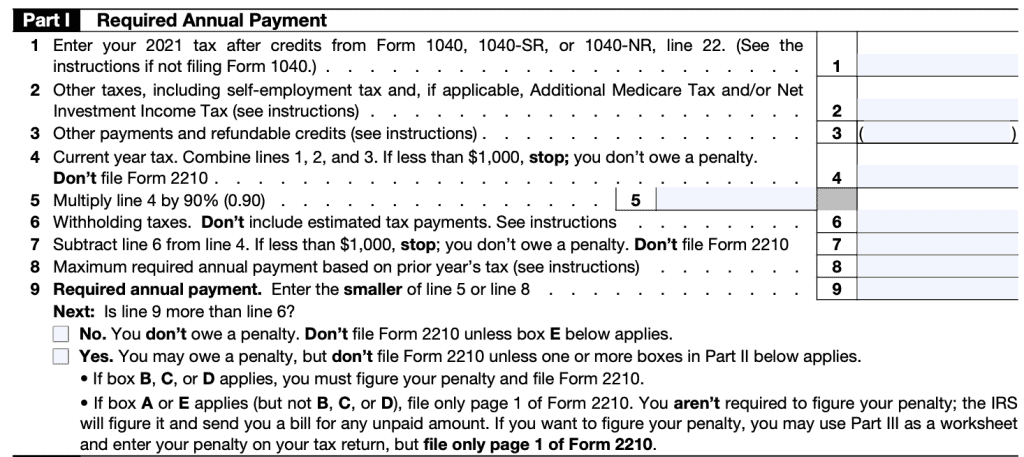

What Are the Penalties for Underpaying Estimated Taxes?

IRS Form 2210 Instructions - Underpayment of Estimated Tax

:max_bytes(150000):strip_icc()/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

:max_bytes(150000):strip_icc()/irs-pub-433.asp-Final-060f721b11b441b0a4b85b4ec6c6186a.jpg)

IRS Notice 433: Interest and Penalty Information

Recomendado para você

-

PENALTY SHOOTERS 2 - Play Online for Free!12 março 2025

PENALTY SHOOTERS 2 - Play Online for Free!12 março 2025 -

What Is A Penalty Kick In Soccer12 março 2025

What Is A Penalty Kick In Soccer12 março 2025 -

The tricky physics of taking the perfect World Cup penalty12 março 2025

The tricky physics of taking the perfect World Cup penalty12 março 2025 -

Penalty kicks may be predictable12 março 2025

Penalty kicks may be predictable12 março 2025 -

Penalty Kick Wiz 🕹️ Play on CrazyGames12 março 2025

-

Fankaty Dabo: Coventry City condemn racist abuse towards player12 março 2025

Fankaty Dabo: Coventry City condemn racist abuse towards player12 março 2025 -

Pollard's late penalty sends South Africa into World Cup final12 março 2025

Pollard's late penalty sends South Africa into World Cup final12 março 2025 -

Cristiano Ronaldo breaks Saudi duck with stoppage time penalty to12 março 2025

-

Australia Beats France on Penalties to Reach World Cup Semifinals12 março 2025

Australia Beats France on Penalties to Reach World Cup Semifinals12 março 2025 -

Seahawks WR DK Metcalf loses his cool again, commits another penalty12 março 2025

Seahawks WR DK Metcalf loses his cool again, commits another penalty12 março 2025

você pode gostar

-

CapCut_project slayer server vip12 março 2025

CapCut_project slayer server vip12 março 2025 -

fica panguando toninho tornado12 março 2025

fica panguando toninho tornado12 março 2025 -

Jogo Zombie Arena no Jogos 36012 março 2025

Jogo Zombie Arena no Jogos 36012 março 2025 -

HALLOWEEN GIFs on GIPHY - Be Animated12 março 2025

HALLOWEEN GIFs on GIPHY - Be Animated12 março 2025 -

Episode 11 - Myriad Colors Phantom World - Anime News Network12 março 2025

Episode 11 - Myriad Colors Phantom World - Anime News Network12 março 2025 -

ThisPC Roblox Player Epic Games Scan LICENS Aimtastic Launcher Studio Acrobat Grammarly tankionline.. Reader DC Ps12 março 2025

ThisPC Roblox Player Epic Games Scan LICENS Aimtastic Launcher Studio Acrobat Grammarly tankionline.. Reader DC Ps12 março 2025 -

Fantasia Infantil Moana Festa Aniversário Princesa Disney, Roupa Infantil para Menina Usado 8599251112 março 2025

-

3x3x3 moyu rs3m 2020 magnetico12 março 2025

3x3x3 moyu rs3m 2020 magnetico12 março 2025 -

Carlinhos Maia FC - Brasil - Família linda ♥️🌻12 março 2025

-

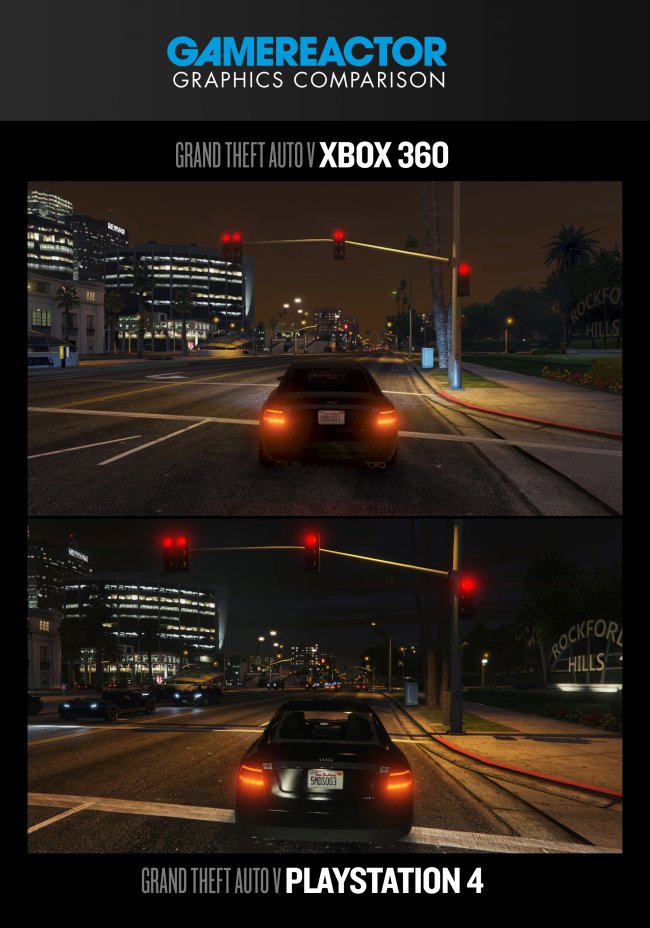

GTAV Graphics Duel: Xbox 360 vs. PS4 - Grand Theft Auto V - Gamereactor12 março 2025

GTAV Graphics Duel: Xbox 360 vs. PS4 - Grand Theft Auto V - Gamereactor12 março 2025