How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Last updated 04 fevereiro 2025

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

The Content Creator's Guide to Self-Employment Taxes

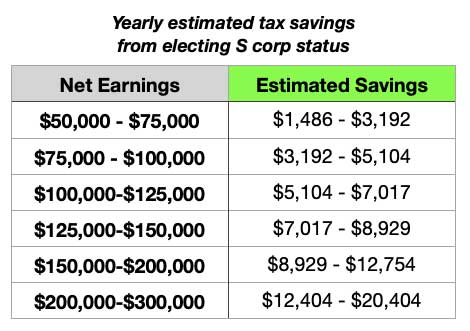

Here's How Much You'll Save In Taxes With an S Corp (Hint: It's a LOT)

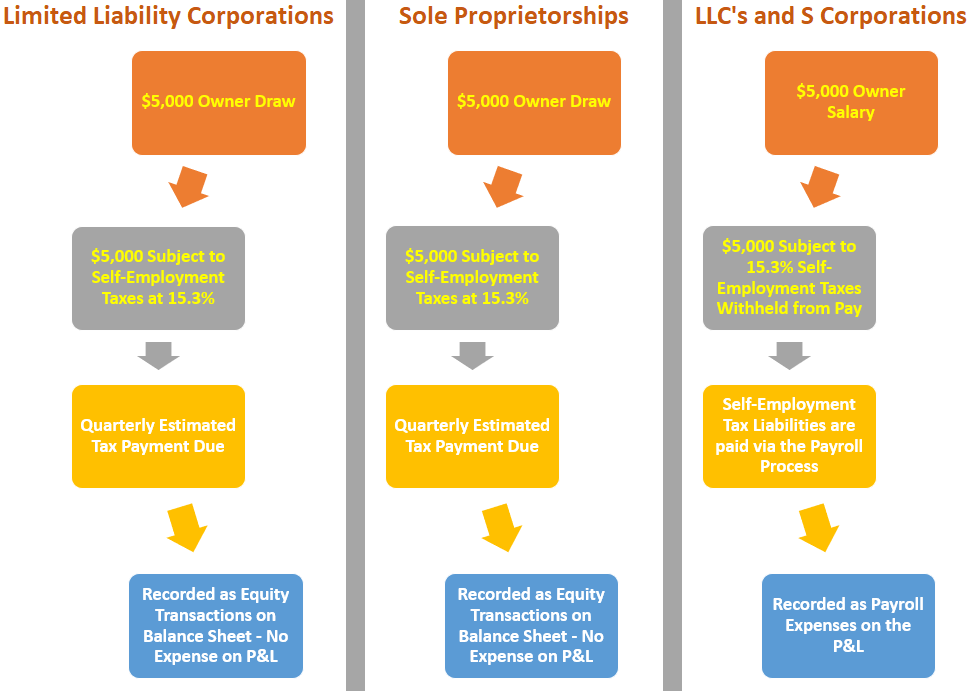

LLC vs S Corp: The Difference and Tax Benefits — Collective Hub

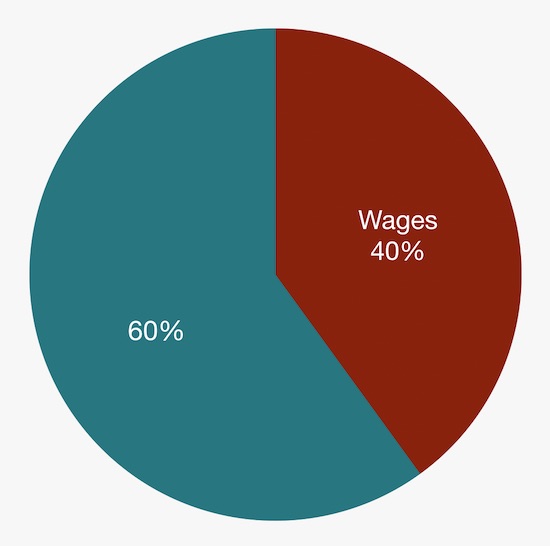

How An S Corporation Reduces FICA Self-Employment Taxes

Why You Should Form an S Corporation (and When)

What You Need To Know About Self-Employment Tax (2023)

16 Tax Deductions and Benefits for the Self-Employed

Converting LLC to S-Corp (Step-by-Step)

What is a C Corporation? What You Need to Know about C Corps

S-Corporations vs. LLC: Example of Self-Employment Income Tax Savings — My Money Blog

What is FICA Tax? - Optima Tax Relief

2023 Tax Tips for Videographers & Photographers: LLC Self Employment Tax — Core Group

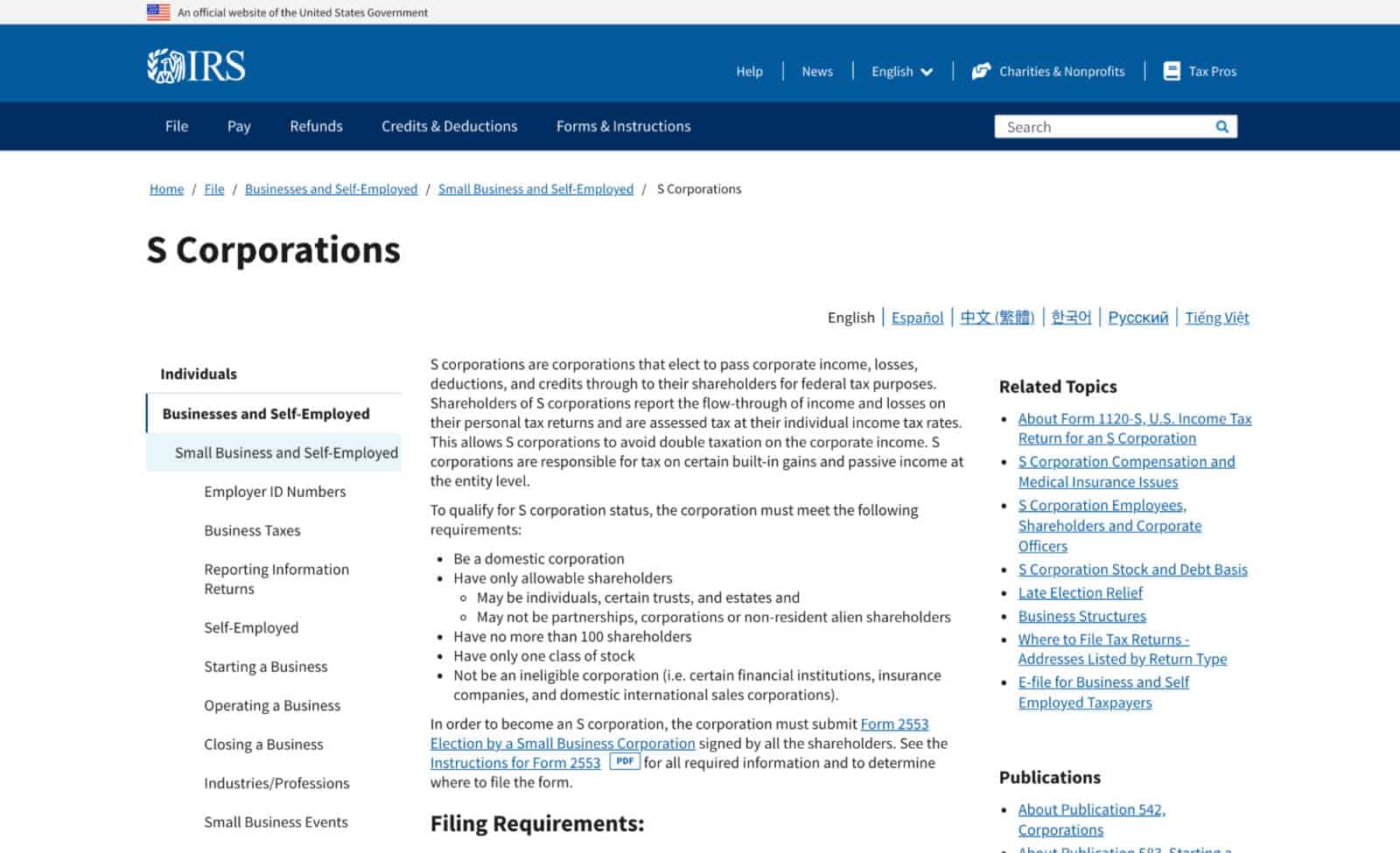

What Is An S Corp?

Understand How Small Business Owners Pay Themselves & Track Self-Employment Tax Liabilities - Lend A Hand Accounting

Recomendado para você

-

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations04 fevereiro 2025

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations04 fevereiro 2025 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202304 fevereiro 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202304 fevereiro 2025 -

2023 FICA Tax Limits and Rates (How it Affects You)04 fevereiro 2025

2023 FICA Tax Limits and Rates (How it Affects You)04 fevereiro 2025 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software04 fevereiro 2025

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software04 fevereiro 2025 -

What Are FICA Taxes And Do They Affect Me?, by M. De Oto04 fevereiro 2025

What Are FICA Taxes And Do They Affect Me?, by M. De Oto04 fevereiro 2025 -

What Is FICA Tax?04 fevereiro 2025

What Is FICA Tax?04 fevereiro 2025 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.04 fevereiro 2025

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.04 fevereiro 2025 -

Understanding FICA Taxes and Wage Base Limit04 fevereiro 2025

Understanding FICA Taxes and Wage Base Limit04 fevereiro 2025 -

FICA Tax Tip Fairness Pro Beauty Association04 fevereiro 2025

FICA Tax Tip Fairness Pro Beauty Association04 fevereiro 2025 -

What Is FICA Tax, Understanding Payroll Tax Requirements04 fevereiro 2025

What Is FICA Tax, Understanding Payroll Tax Requirements04 fevereiro 2025

você pode gostar

-

Sarada Uchiha Canvas Print04 fevereiro 2025

Sarada Uchiha Canvas Print04 fevereiro 2025 -

Edible Internet Memes : rick rolls04 fevereiro 2025

Edible Internet Memes : rick rolls04 fevereiro 2025 -

Pawn Sacrifice Print Alternative Movie Poster Minimal Wall04 fevereiro 2025

Pawn Sacrifice Print Alternative Movie Poster Minimal Wall04 fevereiro 2025 -

VESTIDO CINDERELA - Yukari04 fevereiro 2025

VESTIDO CINDERELA - Yukari04 fevereiro 2025 -

Jogos para bichinho de estimação Star Wars04 fevereiro 2025

Jogos para bichinho de estimação Star Wars04 fevereiro 2025 -

Google's UK executive advises users to cross-check Bard's answers with Google's search engine for accurate information, by Multiplatform.AI04 fevereiro 2025

Google's UK executive advises users to cross-check Bard's answers with Google's search engine for accurate information, by Multiplatform.AI04 fevereiro 2025 -

Mobile Hack Codes - Apps on Google Play04 fevereiro 2025

-

Homesen FX935 2.4G RC Avião Voador Aeronave de Combate com Holofote LED 3CH para Iniciante Espuma EPP Asa Fixa Avião Espuma Avião Controle Remoto Modelo de Avião Brinquedos Crianças Presentes :04 fevereiro 2025

Homesen FX935 2.4G RC Avião Voador Aeronave de Combate com Holofote LED 3CH para Iniciante Espuma EPP Asa Fixa Avião Espuma Avião Controle Remoto Modelo de Avião Brinquedos Crianças Presentes :04 fevereiro 2025 -

Green Day na revista Inked e Tradução « Green Day Inc04 fevereiro 2025

Green Day na revista Inked e Tradução « Green Day Inc04 fevereiro 2025 -

Body Moana Linha LUXO - Loja Mundo da Dança - Roupa de Ballet, Fantasias, Bodys baby.04 fevereiro 2025

Body Moana Linha LUXO - Loja Mundo da Dança - Roupa de Ballet, Fantasias, Bodys baby.04 fevereiro 2025