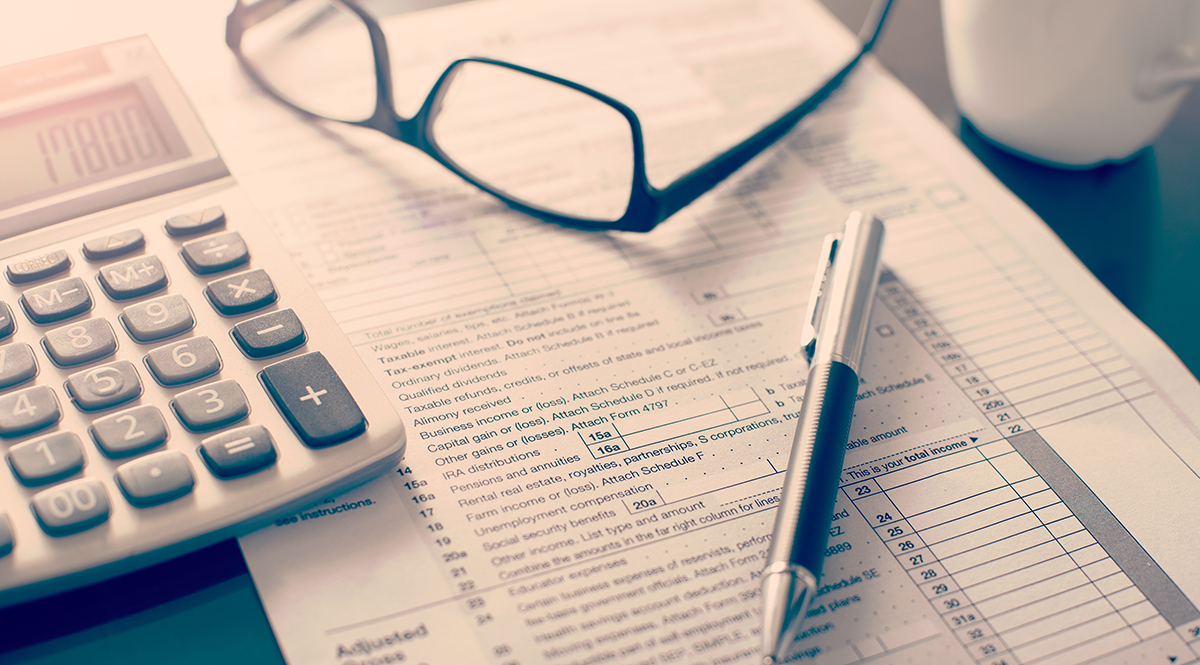

Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Last updated 15 março 2025

Publication 970 - Introductory Material Future Developments What's New Reminders

Tax Credits for Education Waubonsee Community College

IRS CP 79- We Denied One or More Credits Claimed on Your Tax Return

Coverdell Education Savings Account: Exploring the Details in IRS Pub 970 - FasterCapital

Education Tax Credits – Get It Back

Tax Credits For Higher Education

:max_bytes(150000):strip_icc()/taxsmart-ways-help-your-kidsgrandkids-pay-college.aspv2-ca33db2b45af47d2bcd23ca1a70304df.jpg)

Tax-Smart Ways to Help Your Kids or Grandkids Pay for College

New school year reminder to educators; maximum educator expense deduction is $300 in 2023

Teachers' out-of-pocket classroom costs worth $300 tax break - Don't Mess With Taxes

How Student Loans Impact Your Taxes

Publication 970 (2022), Tax Benefits For Education Internal, 60% OFF

Form 8917: Tuition and Fees Deduction: What it is, How it Works

IRS 1098-T Tax Form for 2022

Tax benefits for education cheat sheet

TAS Tax Tip: Tax resources for individuals filing a federal income tax return for the first time - TAS

Do you have to claim student loans on your taxes?

Recomendado para você

-

Pin on rol15 março 2025

Pin on rol15 março 2025 -

Five Star 2 Pocket Folder, Stay-Put Folder, Plastic Colored Folders with Pockets & Prong Fasteners for 3-Ring Binders, For Home School Supplies & Home15 março 2025

Five Star 2 Pocket Folder, Stay-Put Folder, Plastic Colored Folders with Pockets & Prong Fasteners for 3-Ring Binders, For Home School Supplies & Home15 março 2025 -

Five Star Spiral Notebooks + Study App, 3 Pack, 1 Subject, College Ruled Paper, Pockets, 100 Sheets, Home School Supplies for College Student or K-1215 março 2025

Five Star Spiral Notebooks + Study App, 3 Pack, 1 Subject, College Ruled Paper, Pockets, 100 Sheets, Home School Supplies for College Student or K-1215 março 2025 -

Five Star Back to School Bundle: Flex Hybrid NoteBinders 4 Pack, 1 Inch Binders, Notebook and Binder All-in-One, Black, White, Red, & Green (29328AE2)15 março 2025

Five Star Back to School Bundle: Flex Hybrid NoteBinders 4 Pack, 1 Inch Binders, Notebook and Binder All-in-One, Black, White, Red, & Green (29328AE2)15 março 2025 -

Epic Games Confirms The Next Season Of Fortnite Brings Players Back To Chapter 1 - Game Informer15 março 2025

Epic Games Confirms The Next Season Of Fortnite Brings Players Back To Chapter 1 - Game Informer15 março 2025 -

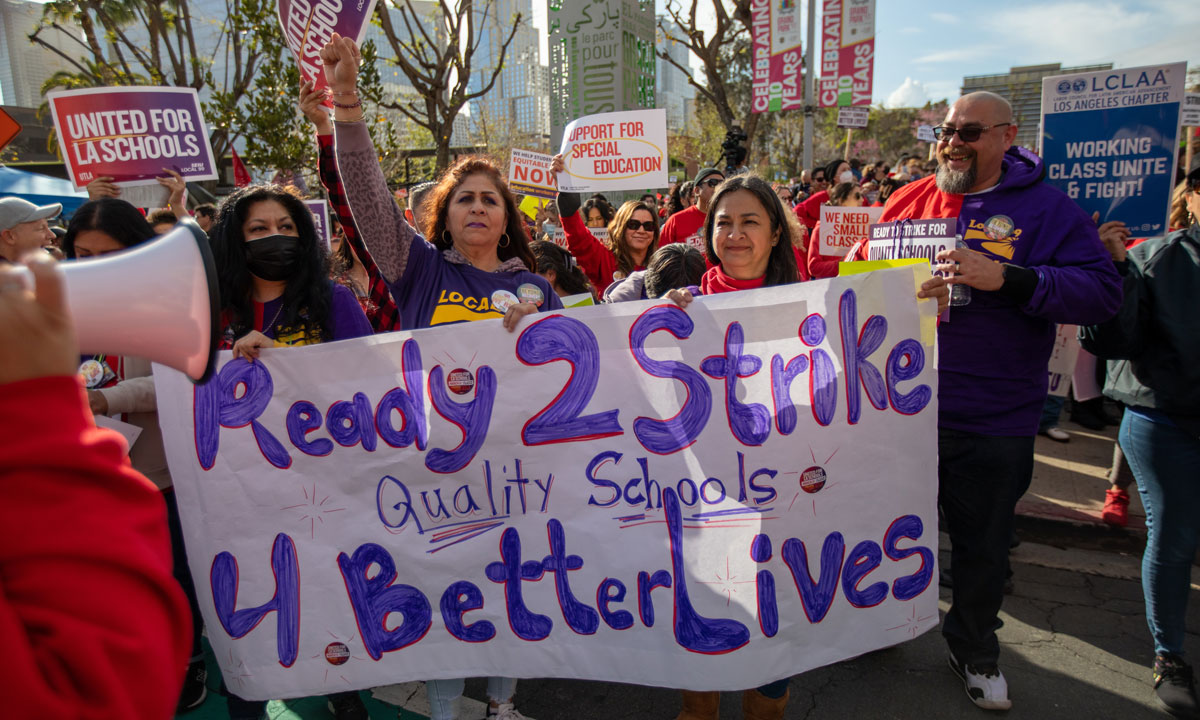

As Schools Close for 3-Day Walkout, Could L.A. Strike Accelerate Learning Loss? – The 7415 março 2025

As Schools Close for 3-Day Walkout, Could L.A. Strike Accelerate Learning Loss? – The 7415 março 2025 -

Chapter 1: Old School Me. Back where it all started. #GXVE coming soon. Link in bio ❤️gx15 março 2025

-

1 Peter Book I: Chapter 1: Volume 23 of Heavenly Citizens in Earthly Shoes, An Exposition of the Scriptures for Disciples and Young Christians15 março 2025

1 Peter Book I: Chapter 1: Volume 23 of Heavenly Citizens in Earthly Shoes, An Exposition of the Scriptures for Disciples and Young Christians15 março 2025 -

All photos about Back to School: All Grown Up page 273 - Mangago15 março 2025

All photos about Back to School: All Grown Up page 273 - Mangago15 março 2025 -

New in School Chapter 1 Page 14 – Albert The Alien15 março 2025

New in School Chapter 1 Page 14 – Albert The Alien15 março 2025

você pode gostar

-

Will There Be Killing Bites Season 2? Is Killing Bites Season 215 março 2025

Will There Be Killing Bites Season 2? Is Killing Bites Season 215 março 2025 -

Lingua Franca: Lollapalooza: a Modern Sockdolager15 março 2025

Lingua Franca: Lollapalooza: a Modern Sockdolager15 março 2025 -

Irão quer suspensão dos EUA por ofensas à bandeira15 março 2025

Irão quer suspensão dos EUA por ofensas à bandeira15 março 2025 -

Wario gets called “sus” and then gets voted out.mp3 - Imgflip15 março 2025

Wario gets called “sus” and then gets voted out.mp3 - Imgflip15 março 2025 -

User blog:Grassies United 2020/BFDI Ship Creator!!!, Battle for Dream Island Wiki15 março 2025

User blog:Grassies United 2020/BFDI Ship Creator!!!, Battle for Dream Island Wiki15 março 2025 -

Majin Sonic, Sonic.exe RP + PVP Wiki15 março 2025

Majin Sonic, Sonic.exe RP + PVP Wiki15 março 2025 -

Kyoukai no Kanata – Anime Review – The Flame15 março 2025

Kyoukai no Kanata – Anime Review – The Flame15 março 2025 -

:max_bytes(150000):strip_icc()/whiskey-smash-1200x628-email-abaaec60e0514af4964a9f8c76776878.jpg) Whiskey Smash Cocktail Recipe15 março 2025

Whiskey Smash Cocktail Recipe15 março 2025 -

Mr. Vampire — Subway Cinema15 março 2025

Mr. Vampire — Subway Cinema15 março 2025 -

![Is Friday the 13th Crossplay? [Detailed Answer]](https://commonsensegamer.com/wp-content/uploads/2022/08/Jason-Friday-the-13th-700x354.jpg) Is Friday the 13th Crossplay? [Detailed Answer]15 março 2025

Is Friday the 13th Crossplay? [Detailed Answer]15 março 2025