What is the FICA Tax and How Does it Connect to Social Security?

Por um escritor misterioso

Last updated 12 março 2025

If you earn a paycheck in the United States, you've probably seen "FICA" somewhere among the taxes, but might not have known what it means. See: Unclear on Social Security Benefits? These Are the 4

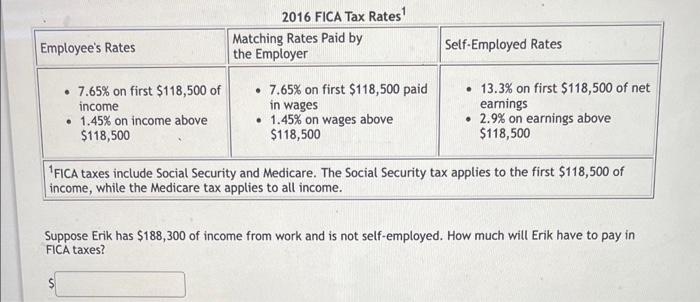

Solved 1 FICA taxes include Social Security and Medicare.

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

Payroll Tax Rates (2023 Guide) – Forbes Advisor

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

What is FED MED/EE Tax?

Social Security wage base is $160,200 in 2023, meaning more FICA taxes for higher earners - Don't Mess With Taxes

How do I set up third party pay for Federal Withholding, Medicare, and Social Security?

How Avoiding FICA Taxes Lowers Social Security Benefits

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

How do I check for different YTD employee and employer amounts for Social Security and Medicare?

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated?

Recomendado para você

-

FICA Tax Rate: What is the percentage of this tax and how you can calculated?12 março 2025

FICA Tax Rate: What is the percentage of this tax and how you can calculated?12 março 2025 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand12 março 2025

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand12 março 2025 -

Social Security Administration - “What is FICA on my paycheck?” Find out12 março 2025

-

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet12 março 2025

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet12 março 2025 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software12 março 2025

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software12 março 2025 -

What Are FICA Taxes And Do They Affect Me?, by M. De Oto12 março 2025

What Are FICA Taxes And Do They Affect Me?, by M. De Oto12 março 2025 -

How An S Corporation Reduces FICA Self-Employment Taxes12 março 2025

How An S Corporation Reduces FICA Self-Employment Taxes12 março 2025 -

What Eliminating FICA Tax Means for Your Retirement12 março 2025

-

Federal Insurance Contributions Act (FICA)12 março 2025

Federal Insurance Contributions Act (FICA)12 março 2025 -

FAQs + What to do about NYU's faulty FICA taxes – GSOC-UAW Local12 março 2025

FAQs + What to do about NYU's faulty FICA taxes – GSOC-UAW Local12 março 2025

você pode gostar

-

Exe 2011 all phases in 2023 Cartoon art styles, Anime girl drawings, Hedgehog art12 março 2025

Exe 2011 all phases in 2023 Cartoon art styles, Anime girl drawings, Hedgehog art12 março 2025 -

Todd Howard diz que The Elder Scrolls 6 pode ser o último12 março 2025

Todd Howard diz que The Elder Scrolls 6 pode ser o último12 março 2025 -

The Top 15 Most Expensive Pokémon Cards12 março 2025

The Top 15 Most Expensive Pokémon Cards12 março 2025 -

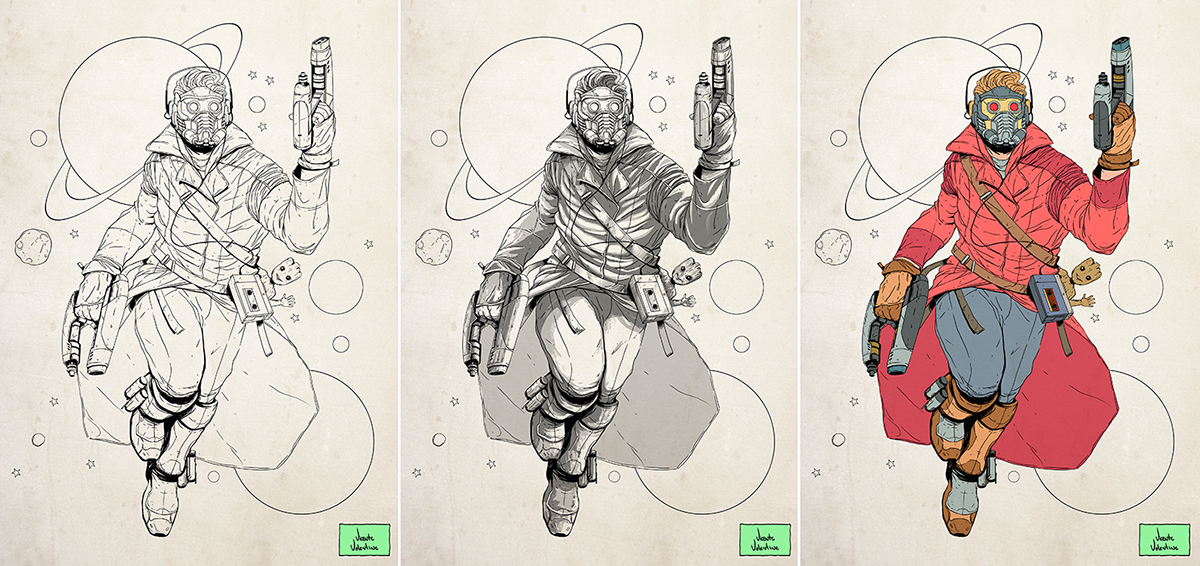

Star-Lord - Commission on Behance12 março 2025

Star-Lord - Commission on Behance12 março 2025 -

Identidade visual: como escolher a melhor paleta de cores para o seu unboxing - Printi Blog12 março 2025

Identidade visual: como escolher a melhor paleta de cores para o seu unboxing - Printi Blog12 março 2025 -

KNT Designs Off-field Uniforms for Tottenham Hotspur F.C. Soccer12 março 2025

KNT Designs Off-field Uniforms for Tottenham Hotspur F.C. Soccer12 março 2025 -

Russian Roulette12 março 2025

Russian Roulette12 março 2025 -

EGAM Official12 março 2025

EGAM Official12 março 2025 -

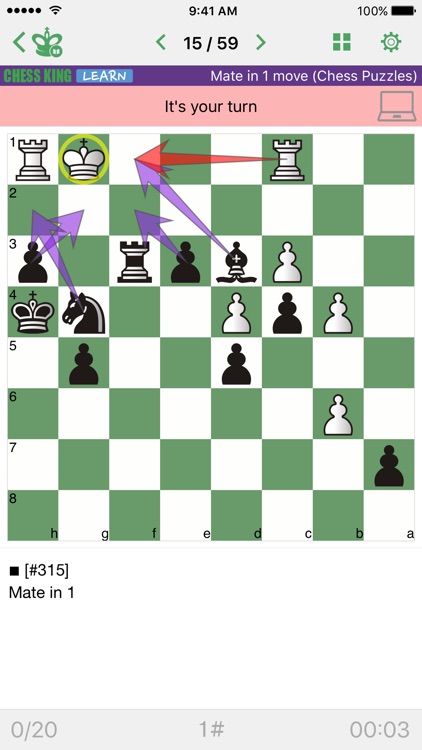

Mate in 1 move (Chess Puzzles) by Chess King12 março 2025

Mate in 1 move (Chess Puzzles) by Chess King12 março 2025 -

Another R36 Concept Render12 março 2025