Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Last updated 12 março 2025

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

Taxation in the United States - Wikipedia

The Ultimate Guide to EU VAT for Digital Taxes

Taxation in the Republic of Ireland - Wikipedia

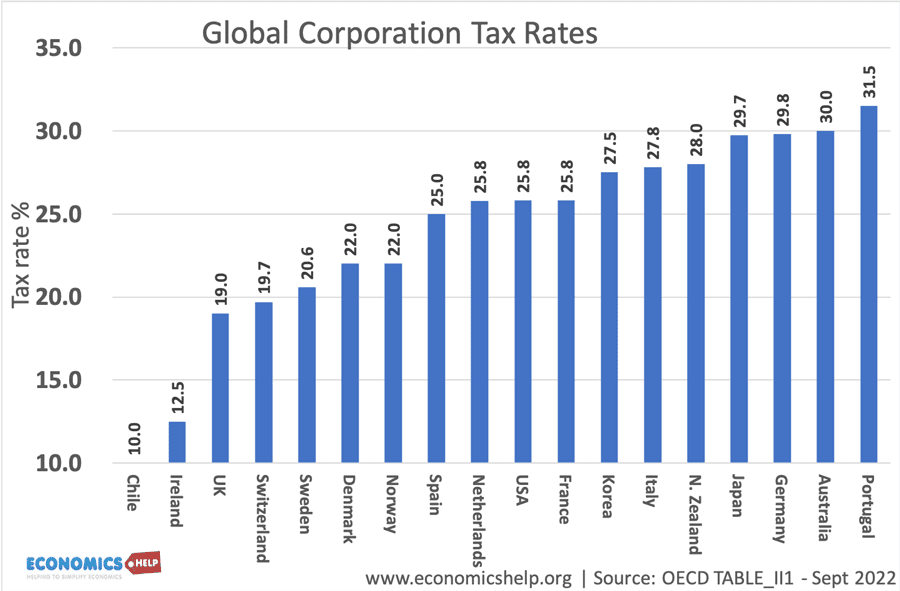

The effect of tax cuts on economic growth and revenue - Economics Help

Refer to the figure below, the effective price sellers receive after the tax is imposed is: a. $1.00 b. $3.50 c. $5.00 d. $6.00

Value Added Tax (VAT) - Overview, How To Calculate, Example

Airbnb's edge on room prices depends on tax advantages

The effect of tax cuts on economic growth and revenue - Economics Help

UK 50th Birthday Newspaper Poster 1973 Newspaper Poster 50

Recomendado para você

-

Shop Subscription - Everything UK Sellers Need to Know - SellerAider12 março 2025

Shop Subscription - Everything UK Sellers Need to Know - SellerAider12 março 2025 -

How to Sell on : 17 Selling tips for UK - Full Fees Calculator12 março 2025

How to Sell on : 17 Selling tips for UK - Full Fees Calculator12 março 2025 -

UK Dropshipping: Start Selling on UK @Dropship Academy12 março 2025

UK Dropshipping: Start Selling on UK @Dropship Academy12 março 2025 -

.co.uk12 março 2025

-

for business –12 março 2025

for business –12 março 2025 -

promotes marketing chief Eve Williams to UK boss12 março 2025

promotes marketing chief Eve Williams to UK boss12 março 2025 -

Announces First UK High Street Concept Store12 março 2025

Announces First UK High Street Concept Store12 março 2025 -

UK Reviews - 188 Reviews of .co.uk12 março 2025

-

Seller Metrics to Keep an Eye on12 março 2025

Seller Metrics to Keep an Eye on12 março 2025 -

Do Sellers Have To Pay VAT On Fees?12 março 2025

Do Sellers Have To Pay VAT On Fees?12 março 2025

você pode gostar

-

Dear My Cat :Relaxing cat game - Apps on Google Play12 março 2025

-

EASTER EGGS y REFERENCIAS a NIKO BELLIC en GTA V12 março 2025

EASTER EGGS y REFERENCIAS a NIKO BELLIC en GTA V12 março 2025 -

Download eFootball PES 2021 Apk + Obb 5.3.0 (UCL Patch) or Android12 março 2025

Download eFootball PES 2021 Apk + Obb 5.3.0 (UCL Patch) or Android12 março 2025 -

Defensoria de dakaretai otoko/chuntaka🛐 on X: #Dakaretaiotoko12 março 2025

Defensoria de dakaretai otoko/chuntaka🛐 on X: #Dakaretaiotoko12 março 2025 -

PlayStation 2 CD-ROM (Concept) - Giant Bomb12 março 2025

PlayStation 2 CD-ROM (Concept) - Giant Bomb12 março 2025 -

USD to PHP Exchange Rate and Currency Converter12 março 2025

USD to PHP Exchange Rate and Currency Converter12 março 2025 -

Escapar da Prisão – Apps no Google Play12 março 2025

-

Oakley Camo Outline Oakley Tee - White12 março 2025

Oakley Camo Outline Oakley Tee - White12 março 2025 -

ESSE MULEQUE É BOM DE PORRADA God of War: Ragnarok (parte 4)12 março 2025

ESSE MULEQUE É BOM DE PORRADA God of War: Ragnarok (parte 4)12 março 2025 -

Prime Video: Don't Toy With Me, Miss Nagatoro: Season 212 março 2025

Prime Video: Don't Toy With Me, Miss Nagatoro: Season 212 março 2025