Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Last updated 12 março 2025

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Solved] estion list The total wage expense for Kiln Co. was

Employees Paychecks - FasterCapital

Payroll Tax Rates (2023 Guide) – Forbes Advisor

How to Calculate Payroll Taxes

Federal & Regular FICA Tax Table Maintenance (FEDM & FEDS)

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age

Maximum Taxable Income Amount For Social Security Tax (FICA)

Federal Insurance Contributions Act - Wikipedia

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

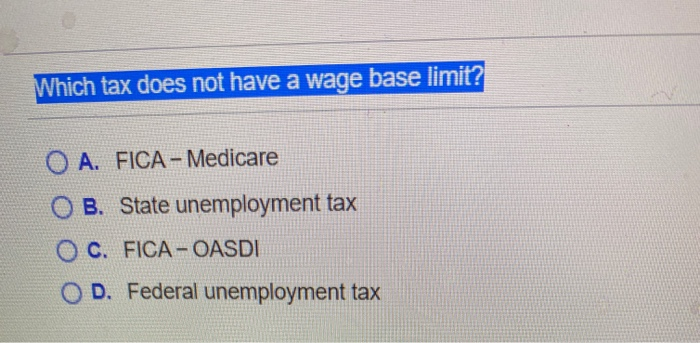

Solved Which tax does not have a wage base limit? O A. FICA

Payroll tax in Texas: What employers need to know

2023 Social Security Wage Base Increases to $160,200

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

What is a payroll tax? Payroll tax definition, types, and

Payroll Taxes, How Much Do Employers Take Out?

Recomendado para você

-

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks12 março 2025

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks12 março 2025 -

Family Finance Favs: Don't Leave Teens Wondering What The FICA?12 março 2025

Family Finance Favs: Don't Leave Teens Wondering What The FICA?12 março 2025 -

What are FICA Tax Payable? – SuperfastCPA CPA Review12 março 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review12 março 2025 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations12 março 2025

What is a payroll tax?, Payroll tax definition, types, and employer obligations12 março 2025 -

What Is FICA Tax? —12 março 2025

What Is FICA Tax? —12 março 2025 -

How Do I Get a FICA Tax Refund for F1 Students?12 março 2025

How Do I Get a FICA Tax Refund for F1 Students?12 março 2025 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student12 março 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student12 março 2025 -

.jpg) What is FICA tax? Understanding FICA for small business12 março 2025

What is FICA tax? Understanding FICA for small business12 março 2025 -

2019 US Tax Season in Numbers for Sprintax Customers12 março 2025

2019 US Tax Season in Numbers for Sprintax Customers12 março 2025 -

FAQs + What to do about NYU's faulty FICA taxes – GSOC-UAW Local 211012 março 2025

FAQs + What to do about NYU's faulty FICA taxes – GSOC-UAW Local 211012 março 2025

você pode gostar

-

God of War Ragnarok Dev Has “No Idea” if the Game Will Come to PC12 março 2025

God of War Ragnarok Dev Has “No Idea” if the Game Will Come to PC12 março 2025 -

Alegria da criançada! Eleito o novo Minecraft, plataforma Roblox12 março 2025

-

) Tata Steel aims to complete Kalinganagar project expansion by Dec 202412 março 2025

Tata Steel aims to complete Kalinganagar project expansion by Dec 202412 março 2025 -

A Clash of Kings The Folio Society12 março 2025

A Clash of Kings The Folio Society12 março 2025 -

Netflix's Avatar: The Last Airbender: Release Date, Cast, Trailer12 março 2025

Netflix's Avatar: The Last Airbender: Release Date, Cast, Trailer12 março 2025 -

Review: Plastic Memories, Ep 3: We've Just Started Living Together12 março 2025

Review: Plastic Memories, Ep 3: We've Just Started Living Together12 março 2025 -

Brinquedo Infantil Casa Da Peppa Noite/dia Com Luz E Som12 março 2025

Brinquedo Infantil Casa Da Peppa Noite/dia Com Luz E Som12 março 2025 -

Grandmaster of Demonic Cultivation: Mo Dao Zu Shi (The Comic / Manhua) Vol. 612 março 2025

Grandmaster of Demonic Cultivation: Mo Dao Zu Shi (The Comic / Manhua) Vol. 612 março 2025 -

Escola Games12 março 2025

-

Marc Pejac - Tatsumaki Sculpt (OnePunch Man)12 março 2025

Marc Pejac - Tatsumaki Sculpt (OnePunch Man)12 março 2025