FICA explained: Social Security and Medicare tax rates to know in 2023

Por um escritor misterioso

Last updated 16 março 2025

What is FICA Tax? - The TurboTax Blog

The Evolution of Social Security's Taxable Maximum

2019 Payroll Taxes Will Hit Higher Incomes

Overview of FICA Tax- Medicare & Social Security

What are FICA Taxes? 2022-2023 Rates and Instructions

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023)

2023 Social Security Wage Cap Jumps to $160,200 for Payroll Taxes

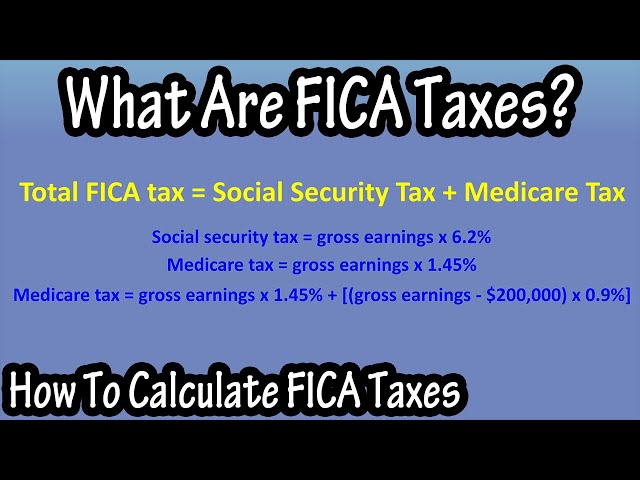

What Is And How To Calculate FICA Taxes Explained, Social Security

The Social Security tax rate for employees is 6.2 percent, a

How To Calculate, Find Social Security Tax Withholding - Social

Medicare Tax: Current Rate, Who Pays & Why It's Mandatory

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog16 março 2025

-

What is the FICA Tax and How Does It Work? - Ramsey16 março 2025

What is the FICA Tax and How Does It Work? - Ramsey16 março 2025 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks16 março 2025

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks16 março 2025 -

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)16 março 2025

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)16 março 2025 -

What Are FICA Taxes And Do They Affect Me?, by M. De Oto16 março 2025

What Are FICA Taxes And Do They Affect Me?, by M. De Oto16 março 2025 -

What Is FICA Tax? —16 março 2025

What Is FICA Tax? —16 março 2025 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and16 março 2025

-

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student16 março 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student16 março 2025 -

Vola16 março 2025

Vola16 março 2025 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.16 março 2025

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.16 março 2025

você pode gostar

-

Mortal Kombat X How to Do All Fatalities Perform PS4 PS3 Xbox One Xbox 360 1016 março 2025

Mortal Kombat X How to Do All Fatalities Perform PS4 PS3 Xbox One Xbox 360 1016 março 2025 -

Rage Quit Protector, 360° Inflatable Contraption Protects for Games Controllers, Transparent Inflatable Gaming Controller Cover, Effectively Protector16 março 2025

Rage Quit Protector, 360° Inflatable Contraption Protects for Games Controllers, Transparent Inflatable Gaming Controller Cover, Effectively Protector16 março 2025 -

Big Sean - Sacrifices ft. Migos (Official Music Video)16 março 2025

Big Sean - Sacrifices ft. Migos (Official Music Video)16 março 2025 -

Found a cool thing: shadow mewtwo has a similar aura to apex shadow ho-oh, but other legendaries like the birds don't. Pretty cool : r/pokemongo16 março 2025

Found a cool thing: shadow mewtwo has a similar aura to apex shadow ho-oh, but other legendaries like the birds don't. Pretty cool : r/pokemongo16 março 2025 -

Goomba Reviews: Sakura Card Captors16 março 2025

Goomba Reviews: Sakura Card Captors16 março 2025 -

to your eternity Gugu and rynn kiss scene (final moments of Gugu) on Make a GIF16 março 2025

to your eternity Gugu and rynn kiss scene (final moments of Gugu) on Make a GIF16 março 2025 -

Photo of Eugene and Tommy, The Last of Us Wiki16 março 2025

Photo of Eugene and Tommy, The Last of Us Wiki16 março 2025 -

Karakai Jouzu no Takagi-san temporada 3 capítulo 4 sub español16 março 2025

Karakai Jouzu no Takagi-san temporada 3 capítulo 4 sub español16 março 2025 -

The Last of Us: Série da HBO Max ganha teaser; veja - Observatório do Cinema16 março 2025

The Last of Us: Série da HBO Max ganha teaser; veja - Observatório do Cinema16 março 2025 -

Freeza Freeza Goku Gohan Vegeta, 11, vertebrado, desenho animado png16 março 2025

Freeza Freeza Goku Gohan Vegeta, 11, vertebrado, desenho animado png16 março 2025