Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 19 março 2025

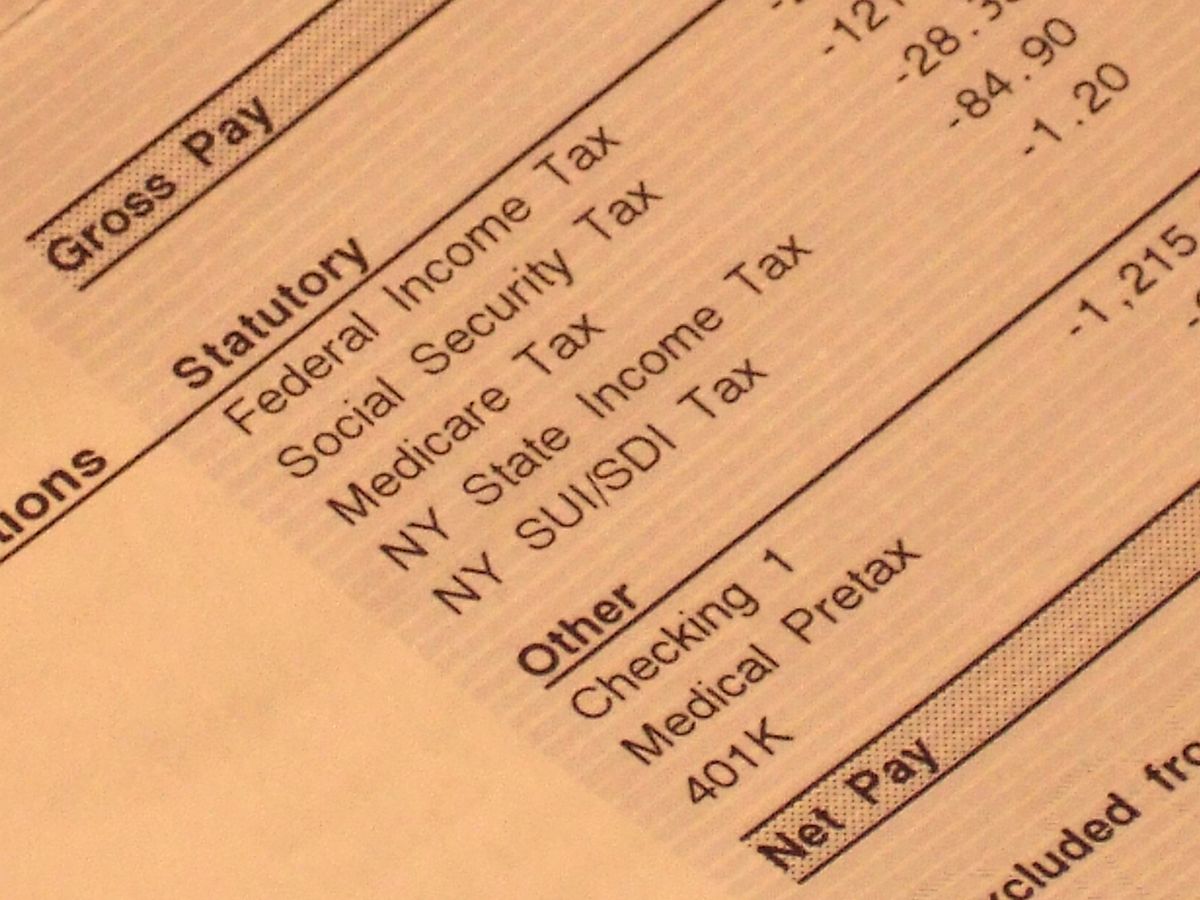

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

What is FICA Tax? - Optima Tax Relief

Social Security Wage Base 2024

2017 FICA Tax: What You Need to Know

Requesting FICA Tax Refunds For W2 Employees With Multiple

Employers responsibility for FICA payroll taxes

Fixing Social Security and Medicare: Where the Parties Stand - The

Maximum Taxable Income Amount For Social Security Tax (FICA)

Fica Tax Rates - FasterCapital

What Is FICA on a Paycheck? FICA Tax Explained - Chime

What is FICA tax?

Payroll Tax Definition, What are Payroll Taxes?, TaxEDU

Social Security Administration Announces 2022 Payroll Tax Increase

Overview of FICA Tax- Medicare & Social Security

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

Recomendado para você

-

What Is FICA Tax? A Complete Guide for Small Businesses19 março 2025

What Is FICA Tax? A Complete Guide for Small Businesses19 março 2025 -

What is FICA Tax? - The TurboTax Blog19 março 2025

-

What is the FICA Tax and How Does It Work? - Ramsey19 março 2025

What is the FICA Tax and How Does It Work? - Ramsey19 março 2025 -

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations19 março 2025

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations19 março 2025 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays19 março 2025

Federal Insurance Contributions Act (FICA): What It Is, Who Pays19 março 2025 -

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand19 março 2025

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand19 março 2025 -

What is the FICA Tax Refund?19 março 2025

What is the FICA Tax Refund?19 março 2025 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax19 março 2025

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax19 março 2025 -

.jpg) What is FICA tax? Understanding FICA for small business19 março 2025

What is FICA tax? Understanding FICA for small business19 março 2025 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine19 março 2025

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine19 março 2025

você pode gostar

-

write the meaning of the following words . you may use a19 março 2025

write the meaning of the following words . you may use a19 março 2025 -

Calvin Harris - I need your love (letra de canción/song lyrics19 março 2025

Calvin Harris - I need your love (letra de canción/song lyrics19 março 2025 -

John Wick 4: Baba Yaga' tem maratona de cenas de ação e história mal elaborada - Prisma - R7 Cine R719 março 2025

-

Playstation Network Name Changes Look To Be Finally Coming19 março 2025

Playstation Network Name Changes Look To Be Finally Coming19 março 2025 -

Twist - Apps on Google Play19 março 2025

-

Secrets Puerto Los Cabos Golf & Spa Resort Pool Pictures & Reviews19 março 2025

Secrets Puerto Los Cabos Golf & Spa Resort Pool Pictures & Reviews19 março 2025 -

My Hero Academia Season 6 Episode 14: Citizens to lose trust in Heroes & live in anxiety19 março 2025

My Hero Academia Season 6 Episode 14: Citizens to lose trust in Heroes & live in anxiety19 março 2025 -

Pokemon Poison Type Symbol Mosaic black19 março 2025

Pokemon Poison Type Symbol Mosaic black19 março 2025 -

Killing Bites - Inaba Ui - Nakanishi Eruza - Nakanishi Taiga19 março 2025

Killing Bites - Inaba Ui - Nakanishi Eruza - Nakanishi Taiga19 março 2025 -

Pamala sent this letter describing Chonda-Za to Jesse.19 março 2025

Pamala sent this letter describing Chonda-Za to Jesse.19 março 2025